GOLDEN VALLEY, Minn. - Like it or not, the burden of saving for retirement is on our shoulders. Generally speaking, many Americans are financially unprepared for their golden years.

So, are you on track?

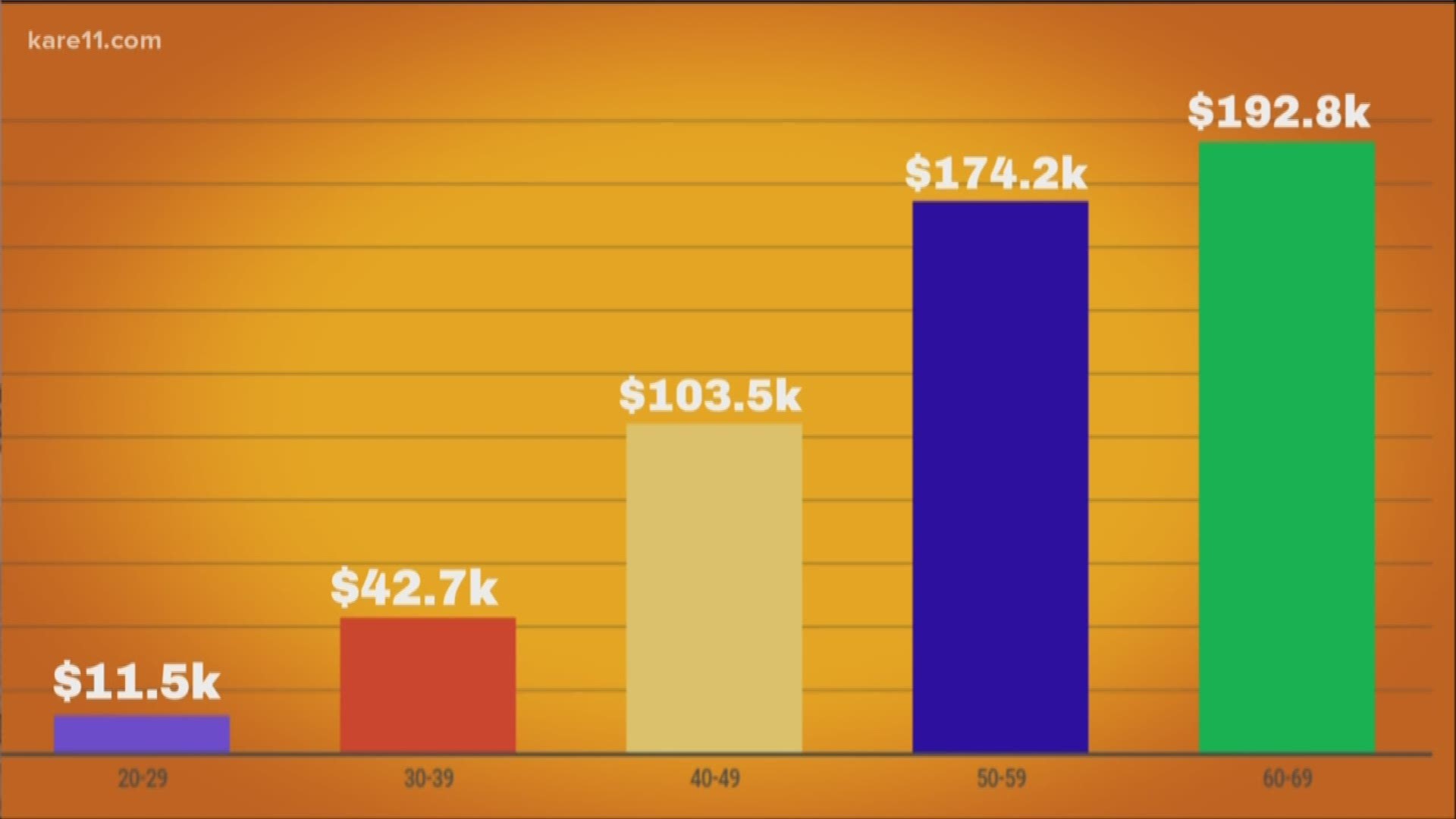

According to Dan Ament, financial advisor with Morgan Stanley, here's how much you should have in your 401(k) at different ages:

- Age 20 to 29: $11.5k

- Age 30 to 39: $42.7k

- Age 40 to 49: $103.5k

- Age 50 to 59: $174.2k

- Age 60 to 69: $192.8k

How much you save each year depends on your specific plans for the future. Many experts suggest saving at least 10 percent of your income each year. Plan on saving even more if you hope to retire early, have longevity on your side or have outsized financial goals.

It’s safe to say most people are not saving enough. A recent estimate indicates that nearly half of American’s have no retirement savings at all.

But saving can be even easier if your employer matches! About 1 in 5 participants don't contribute enough to maximize their employer match.

Approximately 75 percent of companies offering 401(k) retirement plans offer some type of a matching program, generally based on an employee's contributions capped at a percentage of their salary.

If you don’t have access to a 401(k), you have plenty of other options to consider including a traditional, Roth or SEP IRA, a health savings account (HSA) or a normal investment account.