HENNEPIN COUNTY, Minn. — Starting Monday, Hennepin County businesses can apply for up to $15,000 in COVID-19 relief funds.

The grants are available through the Hennepin County Board of Commissioners, which allocated another $8 million in CARES Act funding to help local businesses as new COVID-19 restrictions begin.

The county has already offered three "rounds" of grants, with the latest ending in August.

Hennepin County leaders said an application form will be available online on Monday. All applications must be submitted by Tuesday, Dec. 1 at noon.

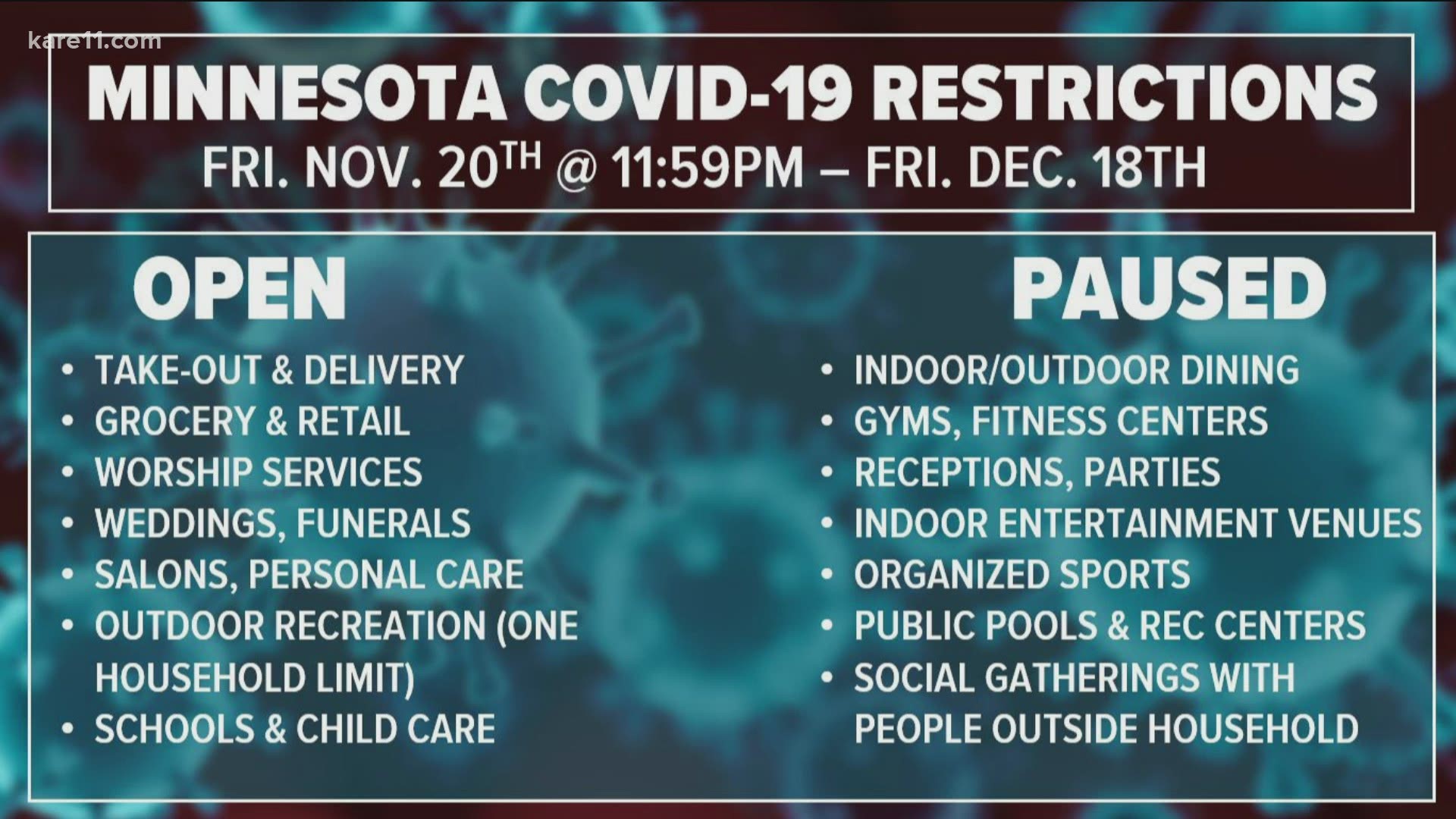

The funding is available for restaurants, bars, gyms and venues. Another $5 million in CARES Act funds remaining from prior relief rounds is available for gyms, fitness facilities, and other indoor recreation, event, and entertainment venues.

Grant amounts will vary. Businesses that have not already received Hennepin County Small Business Relief funds can apply for grants of $15,000. If a business has already received Small Business Relief funds, they can apply for grants of $10,000.

According to Hennepin County, these are the eligible businesses:

- Locally-owned for-profit restaurants, bars, and food service establishments with 100 employees or fewer and under $6 million in annual revenue.

- Locally-owned for-profit gymnasiums, fitness facilities, and other indoor recreation, event, and entertainment venues with 50 employees or fewer.

Ineligible businesses include corporate chains, nonprofits, food trucks, home-based businesses, and businesses that get any income from adult entertainment.

More eligibility criteria, such as COVID-19 preparedness plans, is available here.

According to the Hennepin County website, businesses can use the grants for the following:

- Commercial rent/mortgage payments

- Utilities and other non-payroll operating expenses

- Supplier payments

- Personal protective equipment

- Costs to comply with public health guidance

- Other COVID-19 related expenditures