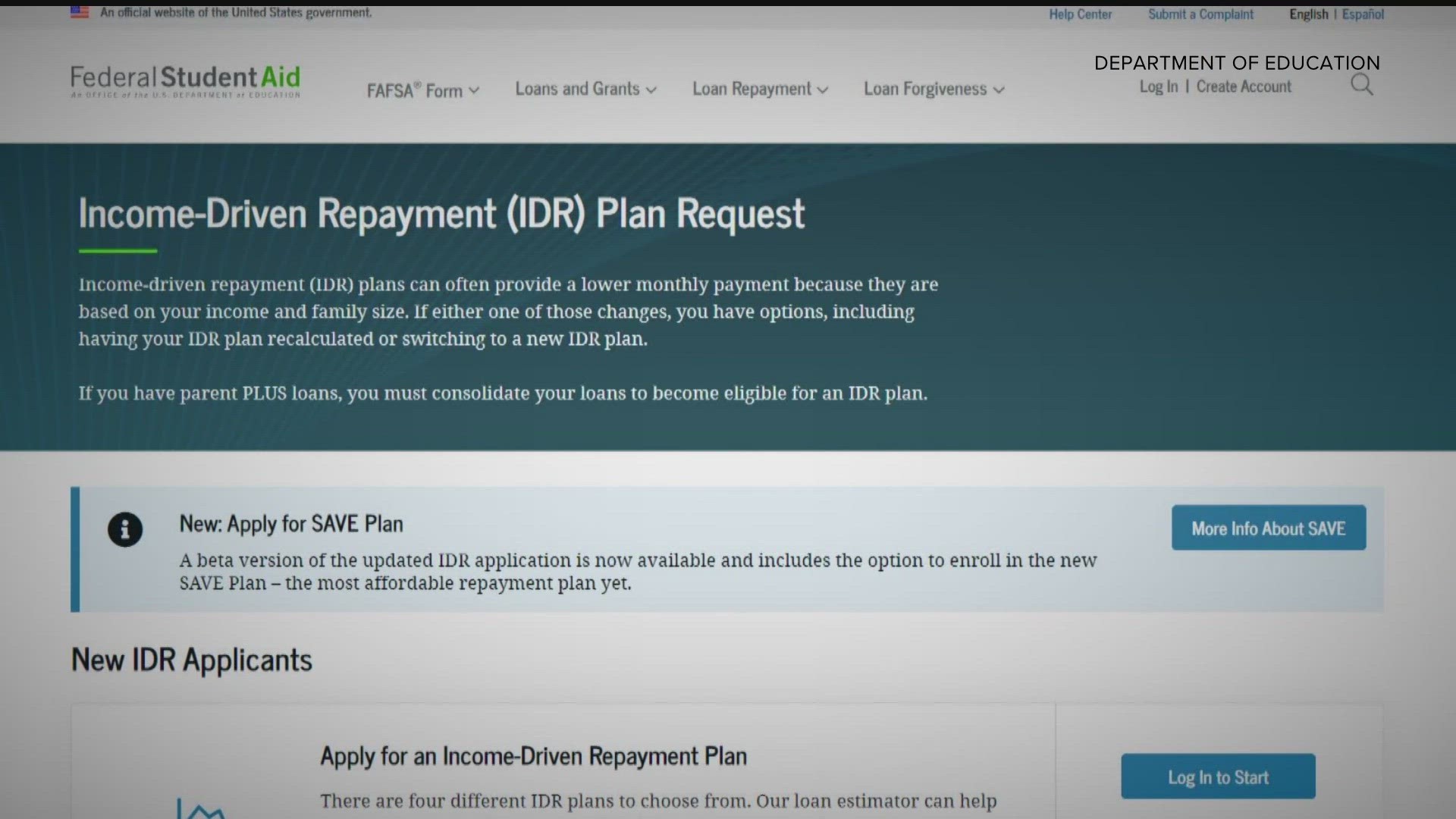

The Biden administration and the Education Department launched a new beta website for a new income-based student loan repayment plan.

The SAVE plan (Saving on a Valuable Education plan) is a new option for student loan borrowers to pay back their loans.

“For most borrowers they will see a lower overall payment plan than what they saw before,” Lutheran Social Service financial counselor Kim Miller says.

Miller says the SAVE plan looks at the borrower's income and family size to determine how low their required monthly payment should be.

For many borrowers that number will be zero dollars a month.

Miller says that means some borrowers on the plan can sign up, not pay anything, and still avoid racking up interest on their student loans.

"Offering a lower repayment plan option is not for everybody, but it can be helpful, especially right now for people who are just looking for a way to ease back into their repayments,” Miller explains.

Under the SAVE plan, more borrowers will qualify for zero-dollar monthly payments.

The threshold for zero-dollar payments is 225% of federal poverty, compared to the 150% requirement for other student loan repayment plans.

The Department of Education estimates that under these new requirements, about one million additional borrowers will qualify for zero-dollar monthly payments.

“There is going to be a lot of leeway to allow people to get used to getting the student loans back into their budget,” Miller explains.

Miller says the SAVE plan also has a forgiveness component to it.

After several years of making payments, borrowers will have their remaining balance forgiven, even if those payments are zero dollars a month.

Miller says the application process is also more convenient than ever.

Borrowers can apply in less than 10 minutes and they don't have to re-apply every year with new information, because the website can now access your tax returns to see which plans and benefits you qualify for.

"We are just encouraging people to take a look. A lot of people have been avoiding looking at their student loans, for good reasons, it can be overwhelming, but there are a lot of different options now,” Miller says.

But this new program comes with a cost.

According to research from the Wharton School at the University of Pennsylvania, the program could cost up to $475 billion over the next ten years.

That's a higher price tag than the $400 billion debt forgiveness program that was rejected by the Supreme Court last month.