MINNESOTA, USA — Tax filing season is officially underway, and if it feels early, well, that's because it is — 17 days early, in fact.

The IRS hopes it will help ease what's already expected to be a difficult year due to severe staffing shortages. The deadline has also been extended to April 18.

The IRS is still processing millions of tax returns from 2020, and Minnesota certified public accountant (CPA) Scott Kadrlik says a vast majority of those returns were filed on paper.

“The electronic filed returns work really well for the IRS because the numbers and the math already work. Nobody has to touch that return. The computer does the work,” Kadrlik says.

He’s encouraging people to file their tax returns electronically to save time.

He also recommends setting up direct deposit with the IRS, because it typically takes the IRS several extra weeks, possibly months, to send a paper check through the mail.

Kadrlik says you can also save time by getting all your important tax forms together before you sit down to file your taxes.

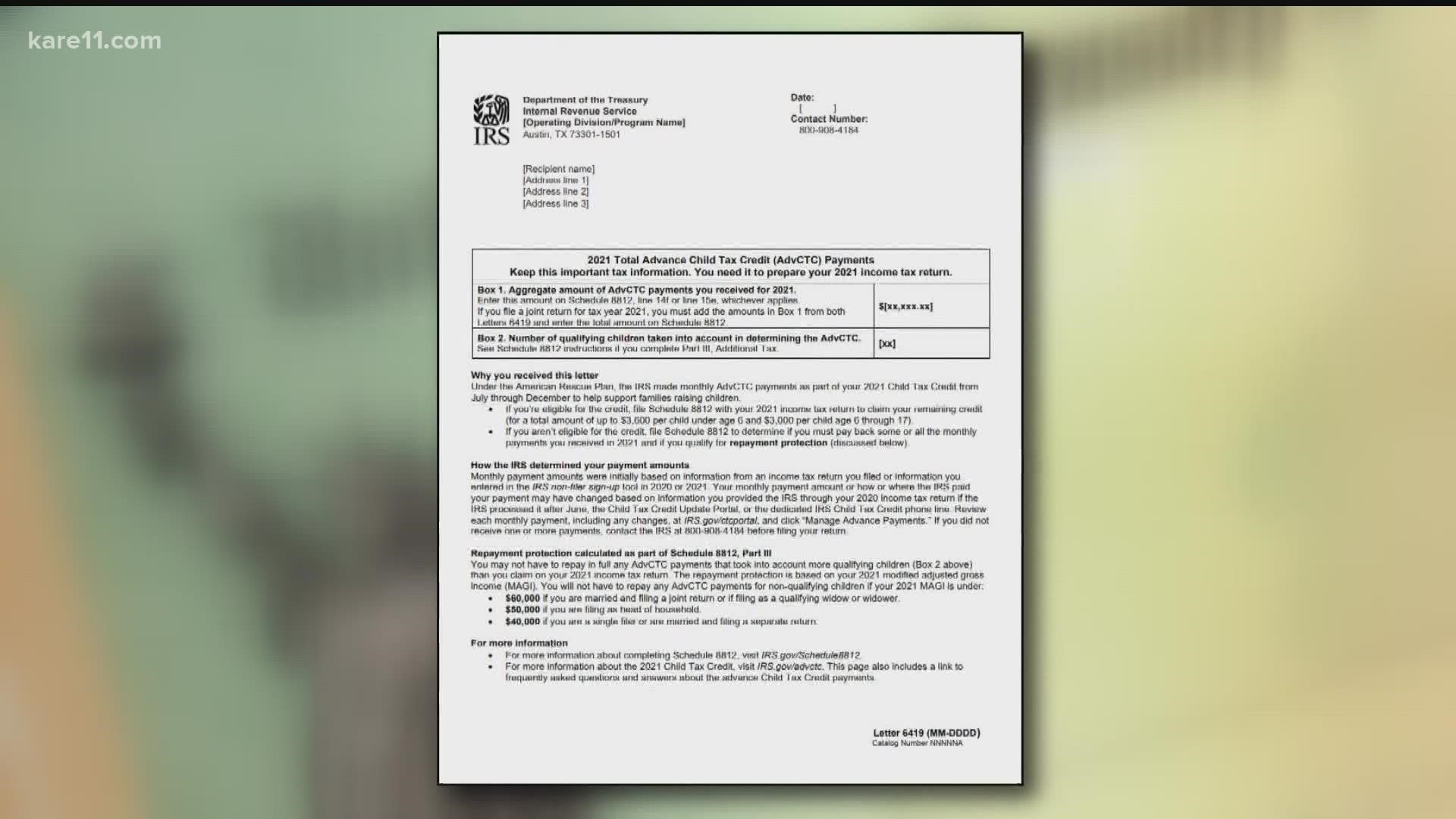

"New for this year, for 2021, the IRS is going to be sending out tax forms related to the child tax credit,” Kadrlik says.

That form is called ‘Letter 6419.’

Some parents have already received that form in the mail, but others may not receive it until later this month.

Kadrlik says the form breaks down a parent’s child tax credit information for 2021.

If you lose that form, Kadrlik says you'll have to sign onto the IRS website and search for all of this information, which could take a while.

"The information is going to be really important to your tax preparer,” Kadrlik says.

The IRS also launched a new website that breaks down everything parents need to know to get the most out of their child tax credit.

If you need help filing your taxes the state does offer free preparation for those who qualify.

The Volunteer Income Tax Assistance and AARP Tax Aide programs will help with both federal and state income and property tax refund returns.

Watch more local news:

Watch the latest local news from the Twin Cities in our YouTube playlist: