MINNEAPOLIS — David McGee is on his way to a big goal. So far, his nonprofit has helped 1,000 Black families into home ownership, one-ninth of the way there.

Build Wealth Minnesota is leading the 9,000 Equities Initiative. The goal is to help Black families own homes.

"Minnesota has some of the largest disparity gaps in the country between white families and black families," said McGee.

Home ownership for white households is at roughly 77 percent. For Black households, that figure is closer to 25 percent, according to the American Community Survey.

"Historically, and currently, there's been a lot of red lining," said McGee. "There has been a lot of predatory practices, the access to capital making it very difficult, some discriminatory practices."

For 20 years, McGee and Build Wealth have fought to combat those challenges.

He and a coalition of other nonprofits are working together to offer financial guidance at a low rate for families who could use the help.

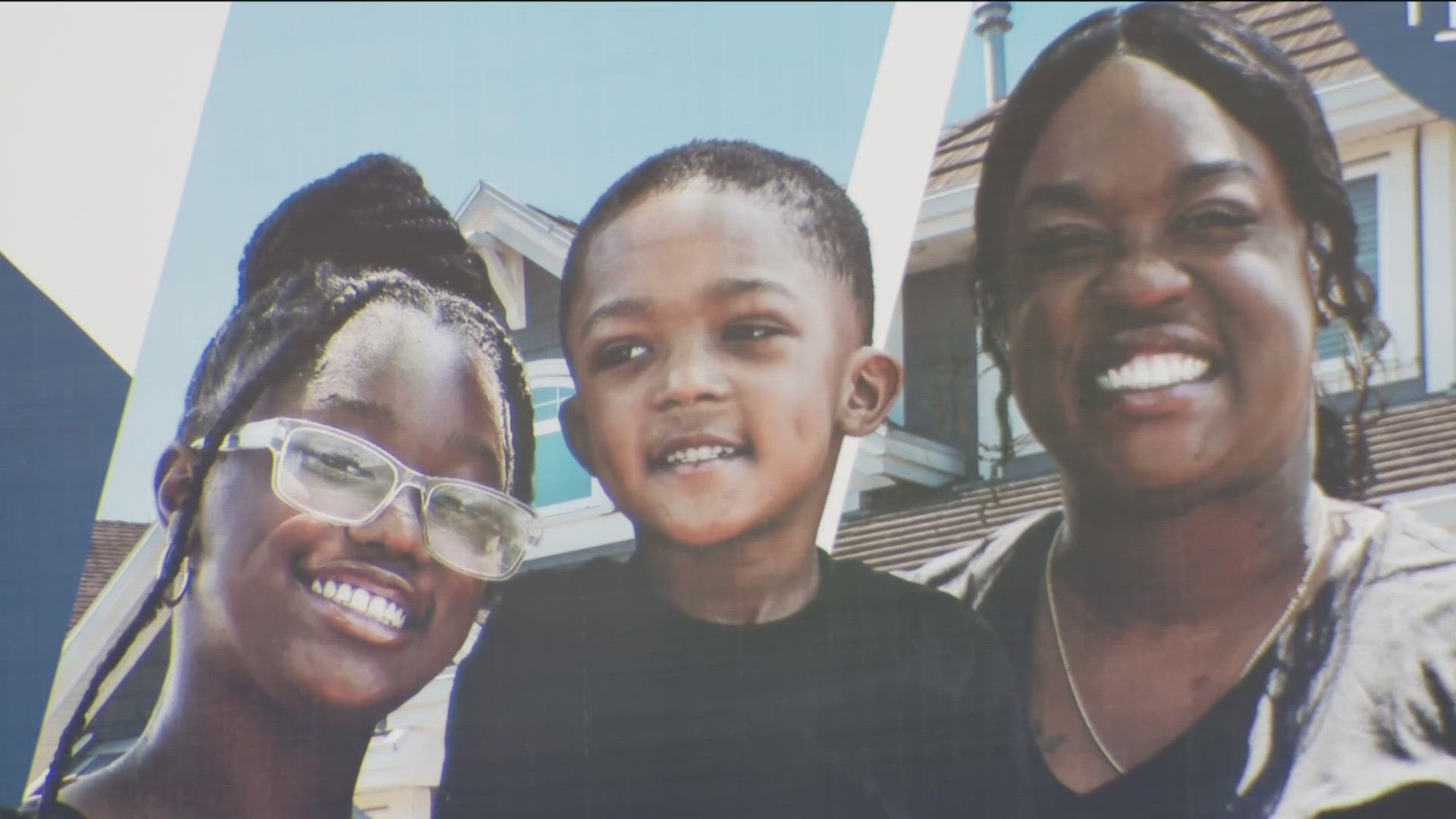

Maelene Rhodes worked with Build Wealth MN for years. She saved up, worked hard, and now has a home for herself and two children.

"I walked in here, and I was like, there's something about this," said Rhodes, smiling, as she sat in her living room.

Her 4-year-old son and her 11-year-old daughter finally have their own rooms. Although, they seem to manage to always stay nearby Mom.

"I can have some free time for a bit, but then they come into my room," she laughs.

Either way, she now has a place to call her own. She and her family are now on billboards across town as the 1,000th family in the initiative.

"She wanted this a long time and she finally got it," said Rhodes' daughter, Jimiah. "It just made me feel happy cause I finally got to live in a house."

McGee says the change in the housing market has meant they are taking longer than expected to get families into homes, but a recent $3 million investment from JPMorgan Chase means they can help families secure loans.

"Nationally, we’re seeing a growing divide in home ownership between black and white households, and it's concerning," said Joanna Trotter, the executive director of corporate responsibility for JPMorgan Chase in Minnesota. "We want to keep cultural identities in the Twin Cities, and ensure people have a stake in their communities."

Watch more local news:

Watch the latest local news from the Twin Cities and across Minnesota in our YouTube playlist: