Many people pursuing public service loan forgiveness for their student debt discover at some point that they don’t qualify, for one technical reason or another.

Dan Ament, Financial Advisor with Morgan Stanley, shares some tips that may save you money.

What is Public Service Loan Forgiveness?

The Public Service Loan Forgiveness program was signed into law by President George W. Bush in 2007 and allows not-for-profit and government employees to have their federal student loans erased after 10 years of on-time payments. An estimated 25 percent of American workers are in public service and could, in theory, be eligible.

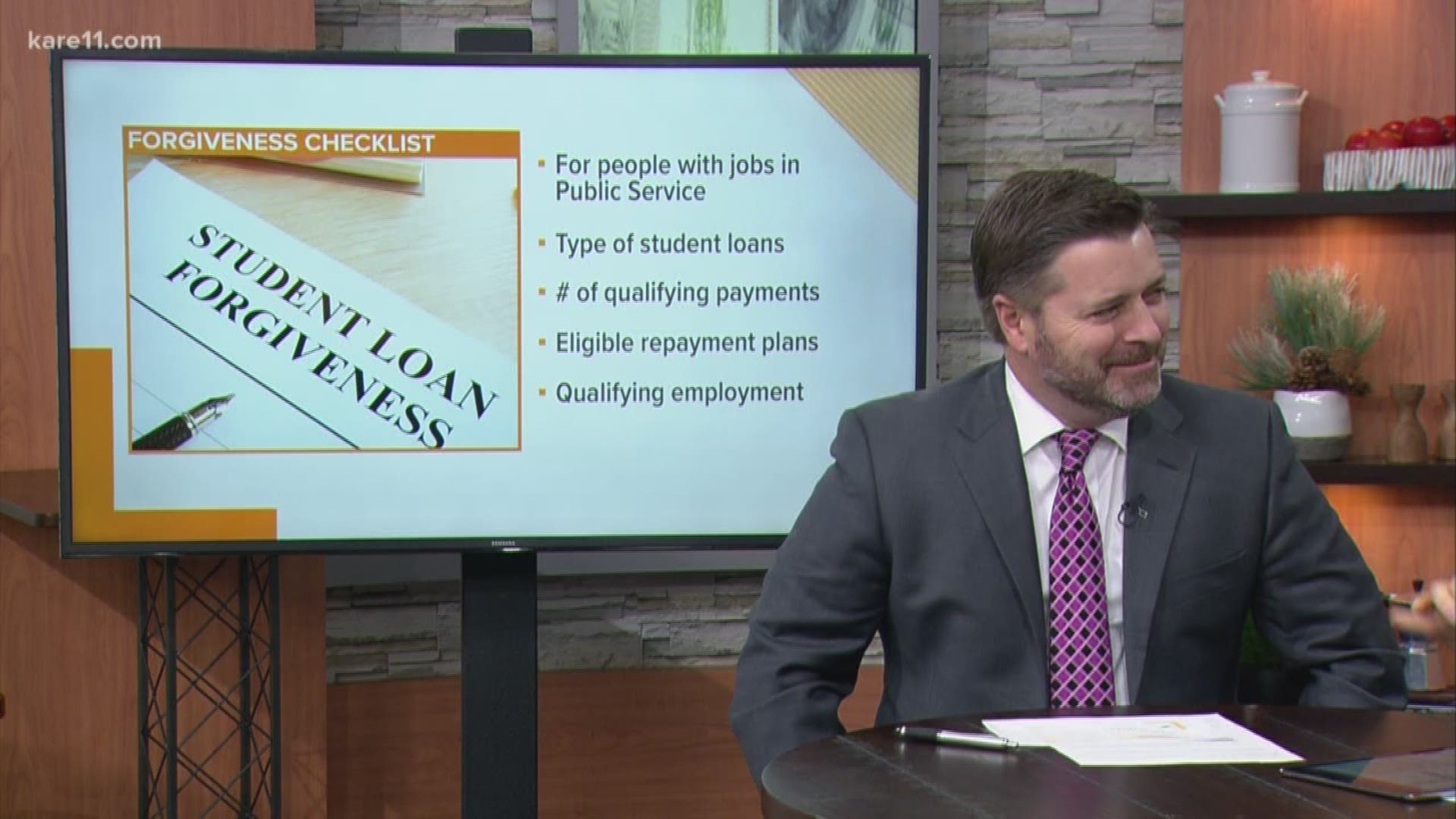

So, do you qualify? This checklist can help you find out:

1. Type of Student Loans

Are your loans Federal Direct Loans, such as Federal Direct Stafford Loans, Federal Direct PLUS Loans and Federal Direct Consolidation Loans? Have you refinanced other federal education loans, such as FFEL program loans and Federal Perkins Loans, into a Federal Direct Consolidation Loan?

2. Number of Qualifying Payments

Have you made 120 qualifying payments since October 1, 2007 on each loan? Payments do not need to be consecutive. PSLF is per loan, not per borrower. Did you make individual payments, as opposed to lump sum payments? Lump sum payments generally only count as only one payment.

3. Eligible Repayment Plans

Did you make the payments while the loans were in an eligible repayment plan? Eligible repayment plans include Standard 10‐year Repayment, Income‐Contingent Repayment (ICR), Income‐Based Repayment (IBR), Pay‐As‐You‐Earn Repayment (PAYE) and Revised Pay‐As‐You‐Earn Repayment (REPAYE).

4. Qualifying Employment

Did you make each payment while working full‐time in a qualifying public service job? Are you still working full‐time in a qualifying public service job at the time you submit the application for PSLF? You must be working in a qualifying public service job at the time the forgiveness is received.

The bottom line is: Do your research to determine if you are eligible to take advantage of this opportunity to help eliminate your student debt!

More from KARE 11 Money: