MINNEAPOLIS - The tax reform bill has a lot of people concerned and turning to financial advisors and accountants for guidance before Jan. 1.

So many have questions about what they should do, especially if they are small business owners, don't have enough withholding from wages to cover taxes, or have large investment portfolios.

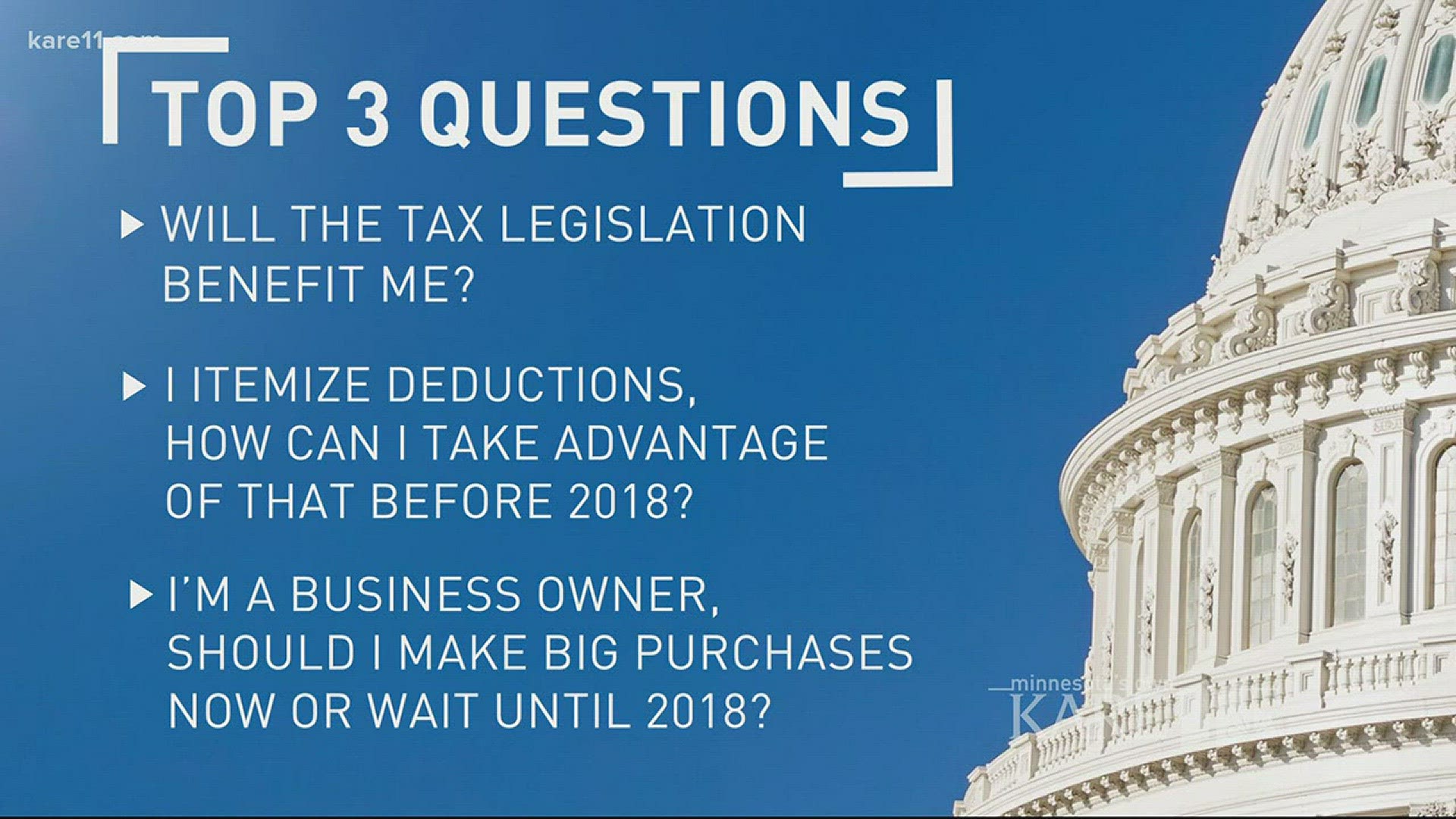

Laura Nickolay, CPA with White Oaks Wealth Advisors, answers three of the most common questions financial advisors are getting.

#1: Will the tax legislation benefit me?

"Our answer is maybe. A lot of people will see lower tax rates but they'll also see decreases to deductions that they have historically taken on their tax returns. For a lot of people it could end up being a wash. It's very situational, client specific."

#2: I itemize deductions. How can I take advantage of that before 2018?

"For people that itemize on their taxes, we are offering a few different suggestions. One is to prepay your property taxes for 2018 before the end of the year and then another one would be to pay any balance due that you estimate you will have in April to Minnesota or another state by the end of December as well."

#3: I'm a business owner. Should I make big purchases now or wait until 2018?

"Business owners will see more preferential depreciation rates in 2018 so people should delay large machinery purchases or other office equipment until 2018 where they can get better deductions on those items. Business owners should also look to delay income into 2018 when rates will be lower."

For the latest on what's in the bill and how it will affect you, click here.