MINNEAPOLIS — Small business owners, especially those shuttered by emergency orders issued by the governor, can now apply for emergency loans from the Minnesota Department of Employment and Economic Development, or DEED.

One option, the Small Business Emergency Loan program, offers loans between $2,500 and $35,000 to small businesses with zero interest, and those are 50 percent forgivable.

"The way it works is we leverage lenders across Minnesota to issue these loans to their communities through money DEED encumbers to them," DEED Commissioner Steve Grove told reporters Monday.

"It’s our goal those lenders have all the money they need and within 24 hours of receiving those applications at DEED we can turn around that funding and get that money out quickly, which is really the whole point of this."

Another option is the Small Business Loan Guarantee program, in which companies with fewer than 250 employees can apply for private loans up to $200,000 that are financially backed by the state.

More information about both programs are available on DEED's website.

The emergency loan program was established through an executive order by Gov. Tim Walz, as part of an effort to mitigate the impact of his executive ordered that shuttered bars and dining in at restaurants; both were deemed necessary to slow the spread of coronavirus and buy the state more time to prepare for huge influx of critical care patients.

The loan guarantee program was created by the legislature in its second COVID-19 response bill, passed March 26. That $330 million package of aid also included earmarks for shelters, food shelves and health providers.

The loans are made by banks and other lenders, but 80% of the loan amount is backed by the state funds, greatly reducing the liability of the lending institution. Commissioner Grove asked lenders interested in participating to visit the same web page.

Grove said his staff is still sorting through the business assistance language of federal relief bill, known as the CARES bill that passed Congress and was signed by President Trump.

That bill, among other things, pays for additional weeks of unemployment benefits for furloughed workers. It also provides up to $600 a week in addition to the state's unemployment benefits, which are 50 percent of your pay up to $740 per week.

DEED still strongly encourages people to apply online rather than attempting to do it over the phone.

And, because the unemployment insurance applications are coming in at an unprecedented pace, the agency implemented new temporary rules Monday.

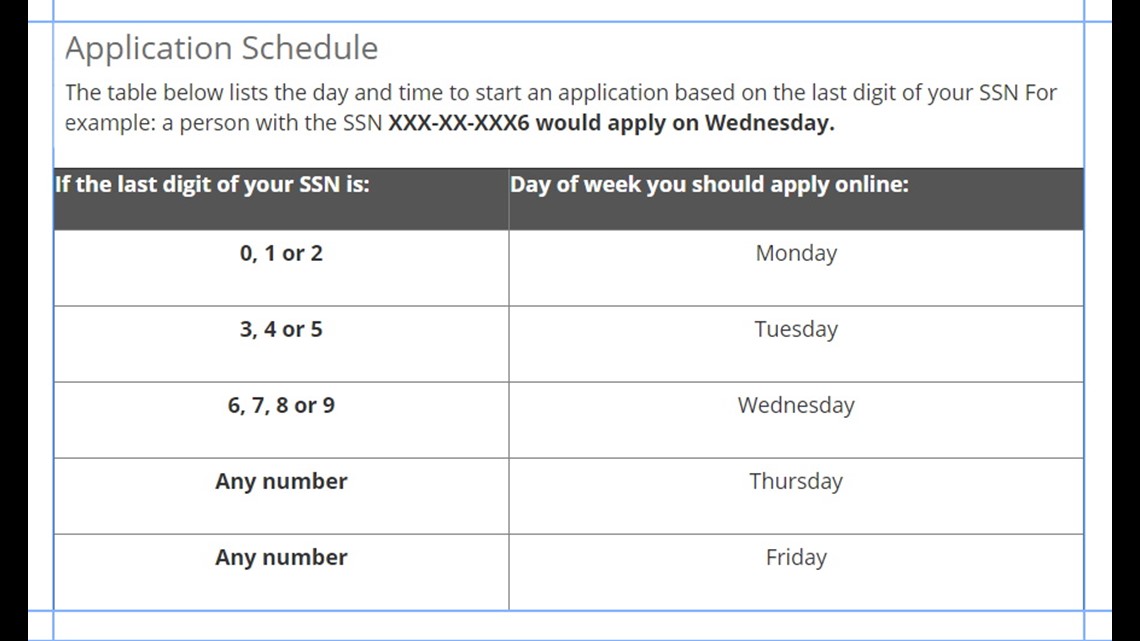

On Mondays, applications will only be taken from those whose Social Security numbers end in 0,1 or 2. On Tuesdays, applications will be accepted from those with Social Security numbers ending in 3, 4 or 5. On Wednesdays, they'll accept applications only from those with Social Security numbers ending in 6, 7, 8 or 9.

Thursdays and Fridays are open for anyone to apply regardless of number.