MINNEAPOLIS - Minnesota Attorney General Lori Swanson is trying to get refunds for Minnesota consumers who purchased a bogus extended car warranty protection plan offered by a company no longer in business.

"My hope is for a happy ending," Sandy Serier told KARE 11.

Serier purchased a maroon Nissan Murano from Kline Nissan in Maplewood, Minn. in 2009. Along with her new ride, the Danbury, Wis. grandmother put down $2,500 for an extended warranty protection plan.

"Twenty-five hundred dollars is a lot of money," she said.

Serier said the dealership salesman made a pitch for the extended warranty that she couldn't turn down.

"If I did not use it at all," she remembers him saying, "then they were to refund my money."

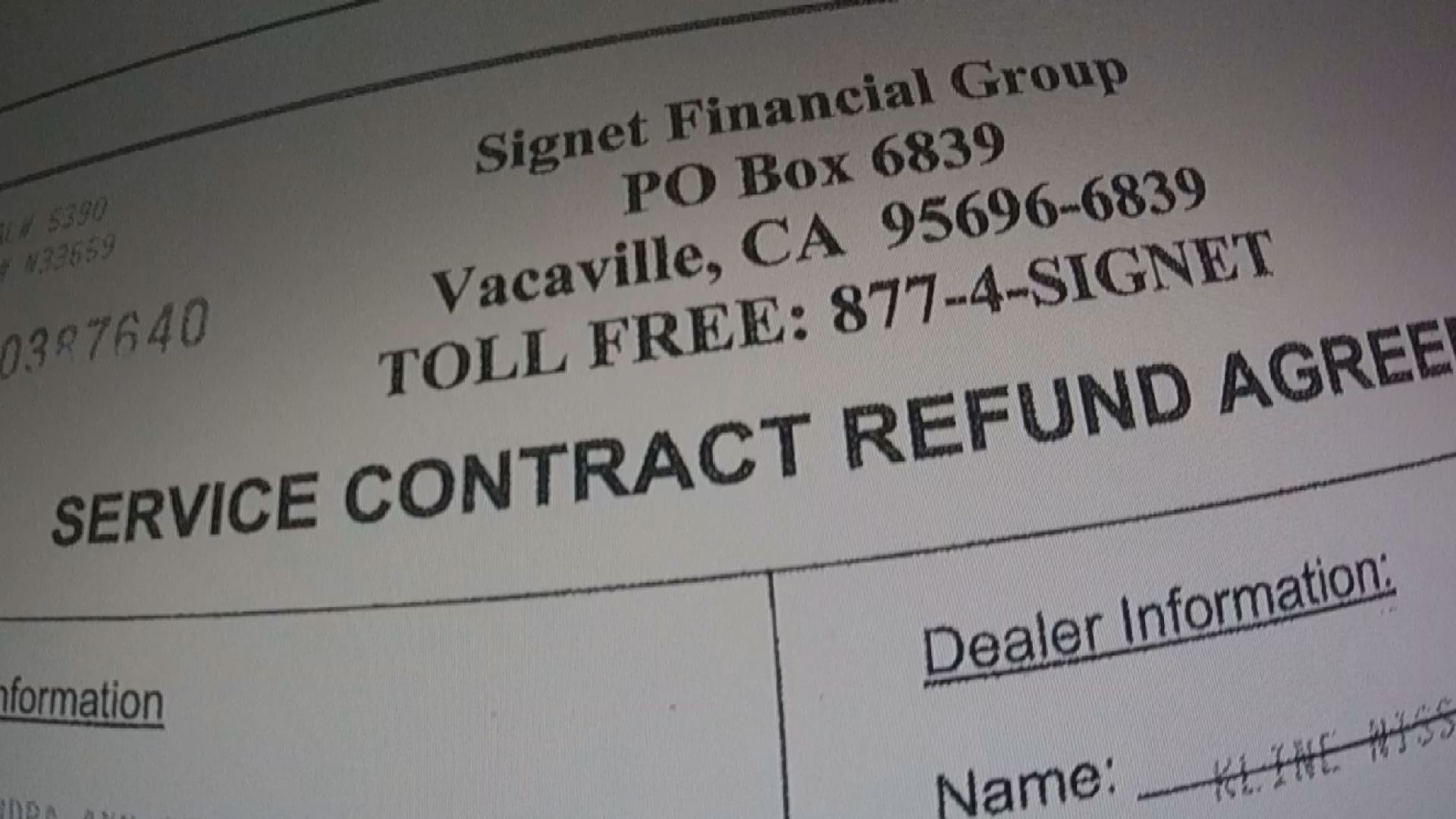

It's true. The dealership offered her a service contract refund agreement by a third party company called Signet Financial Group. The contract says, in black and white, that if the warranty "is never used," Serier would get a refund of the "full purchase price."

"It felt like it was a win-win policy at the time," she said.

Years passed and Serier never used her extended warranty. But when she applied for her refund, she learned Signet Financial Group was not going to honor its contract and refund her money.

"I can't get a hold of the company," she said.

KARE 11 tried calling the number listed for Signet Financial Group on Serier's contract, too. All we got was a recording about a cruise to the Bahamas.

Signet had disappeared.

When Serier contacted the office of the Minnesota Attorney General, Swanson sent several letters to Signet Financial, but never heard back. So, they sent Serier a letter that "strongly encouraged" her to contact the state commerce department.

Mike Rothman is commissioner of the Minnesota Department of Commerce. His department normally regulates motor vehicle service contracts and requires companies offering the warranties to carry insurance in order to ensure they meet their financial obligations to consumers.

Rothman told KARE 11 investigative reporter A. J. Lagoe that he's received other complaints about Signet.

"As your agents have looked at complaints that have come in about Signet, what did you find out about this company?" asked Lagoe.

"Fundamentally, it's a consumer rip-off," Rothman said. "It's a Ponzi scheme-like structure."

But there's a catch. Because of a legal loophole, Rothman says his department doesn't have authority to do anything about Signet.

"This falls through a crack?" Lagoe asked.

"This is not a regulated contract," Rothman said. "It's an unregulated company. The department doesn't regulate it."

Lagoe asked how that could be.

"I've looked at one of the contracts. I think people see in big bold letters 'Service Contract Refund Agreement,'" Lagoe explained. "Can that lead them to think, 'I'm getting a service contract and the protections that come under Minnesota law with the purchase of something like that?'"

"Yes," Rothman said. "It's a misleading and fraudulent statement."

Commerce officials sent letters to Serier and other Signet victims, telling them that because it didn't have the authority to regulate the contract, they should "contact the Minnesota Attorney General's Office."

That's the same agency that sent Serier to commerce in the first place.

"I am at my wit's end," she said. "I don't know where to go with this anymore."

That's when she contacted KARE 11. Our investigation discovered that Serier is not alone. Consumers all across the country have complained they were ripped off by Signet's extended warranty rebate program.

Some auto dealers, including Buerkle Acura in Brooklyn Park, stepped up and paid their customers' refunds themselves.

Buerkle sent KARE 11 this statement:

"At Buerkle Acura, taking care of our customers is our number one priority. When it came to our attention that Signet Financial Group, Inc. was not responsive to processing claims under the agreements written with them, we made arrangements to set aside reserve funds to pay any valid claims brought to us. To date, we have paid a substantial number of claims. We plan to continue to honor claims under the Signet agreements until they expire. We sincerely apologize to any of our valued customers for any inconvenience caused by the non-performance of the Signet Financial Group, Inc."

Other dealers took a different approach.

Kline Nissan, where Serier purchased her vehicle and the Signet contract, would not pay the refund. Kline's attorney wrote a letter last August to the attorney general's office regarding Serier's claim. It says, "… any refund Ms. Serier is entitled is a financial obligation of SFG (Signet Financial Group) rather than Kline Nissan."

Should dealers be held responsible?

KARE 11's investigation found that in Oregon, the attorney general not only went after Signet's owner Greg Lehman on behalf of consumers, she also pressured dealers who sold the Signet warranties to chip in.

So we contacted the office of Minnesota's Attorney General, asking what was being done to protect Minnesota consumers.

After hearing from KARE 11, Swanson's office decided to open a formal investigation.

Last month, the attorney general's office fired off letters to Minnesota auto dealerships, including Kline Nissan.

The letter tells dealers it would "seem appropriate" for them to make a refund to customers to cover the "purchase price of the warranty."

Why? The letter says it's "troubling" the dealerships apparently used the "refund guarantee" as a "marketing device." Referring to cases like Serier's, the letter says it appears "this consumer would not have purchased the warranty but for the lure of a 'guaranteed refund.'"

With that letter from the attorney general in hand, KARE 11 paid a visit to Kline Nissan. No managers would come talk with us, but a day later, dealership owner Rick Kline emailed the following statement:

"We believe that we are one of several dealers that offered this product as an option to our customers. We have been working with the office of the Attorney General to resolve issues relating to Signet Financial Group going out of business. This is an unfortunate situation for everyone involved, as we sincerely strive to offer our customers a choice from products and services that will continue to provide long-term value."

But Serier says the line between value and rip-off has been crossed.

"I really want my money back," she said.

For now, it seems that happy ending Serier wants has yet to be written. But she vowed not to give up.

"I'm sticking with it," she said.

No one knows just how many of the Signet refund contracts were sold in Minnesota, but if you have one and are owed a refund, the attorney general's office now recommends consumers take these steps:

- If they are concerned that they were sold one of these by their car dealer, and if they haven't done so already, they should go to their dealer, who seems to be the only solvent party left, and see if they will voluntarily refund the money.

- If they wish to file a complaint about their car dealer, they should file a complaint with the Department of Public Safety, which licenses and regulates car dealers in Minnesota.

- They may file a complaint about their car dealer with our office, as well. Consumers may call our office at (651) 296-3353 or 1-800-657-3787, or download a complaint form from our website at www.ag.state.mn.us.