MINNEAPOLIS - Internal pharmacy records obtained by KARE 11, along with two newly filed class-action lawsuits, raise questions about whether some popular insurance plans are overcharging customers for prescription medicines and pocketing the profits.

What’s more, documents obtained during KARE 11’s yearlong investigation reveal that so-called “gag clauses” often prevent local pharmacists from disclosing lower prices, effectively keeping customers in the dark about the overcharges.

“I think if people really knew what was going on, there’d be an uproar,” says Tim Gallagher.

Gallagher says he saw the insurance overcharges first-hand when he worked as a pharmacist. Now, he’s with a company that advocates for independent pharmacies.

“Patients were actually paying more than they could otherwise have paid if they were paying cash,” Gallagher told KARE 11.

KARE 11 began investigating the issue last year after we told the story of Twin Cities resident Curt Burshem.

When Burshem tried to refill a prescription for a life-saving kidney drug, he discovered his insurance copay was almost twice as expensive as just paying cash for the same medicine.

His copay was $476. The cash price, without insurance, was just $259.

"It makes me insane,” Burshem told KARE 11.

How could that be?

A WHISTLEBLOWER SPEAKS OUT

For nearly a year, KARE 11 has been investigating, uncovering evidence that what happened to Burshem is happening more often than you think.

“In my opinion, it needs to stop,” said a working pharmacist.

He spoke with KARE 11’s Jay Olstad on the condition we not reveal his identity. He’s afraid of retaliation by insurance plans that, he says, are routinely overcharging customers.

Jay Olstad: “Consumers are paying more because they have insurance, in some cases?

Pharmacist: “It’s probably 20 to 25 percent of the claims.”

Jay Olstad: “A lot?”

Pharmacist: “A lot.”

And there’s evidence it’s happening all across the country.

"These type of shell games go on all the time,” says Doug Hoey, CEO for the National Community Pharmacists Association.

He blames Pharmacy Benefit Managers, or PBMs, for price gouging. PBMs serve as the middle man between insurance providers and pharmacies. And, often, they set the price you pay.

“They dictate that price,” Hoey explained.

“COPAY” MORE EXPENSIVE THAN PAYING CASH?

Here's how it works. When you use an insurance card, the pharmacist punches the information into the computer and the PBM spits out the amount you owe, the so-called insurance “copay.”

“They dictate what the pharmacy can sell it for,” Hoey said.

KARE 11 obtained rarely seen internal records from pharmacists. They were careful to block out private patient information.

But you can still see how the insurance “copay” set by the PBMs was much higher than the cash price at the same pharmacy.

For example, the anti-depressant Venlafaxine:

- $67.13 with the insurance copay.

- $24.99 if you paid cash.

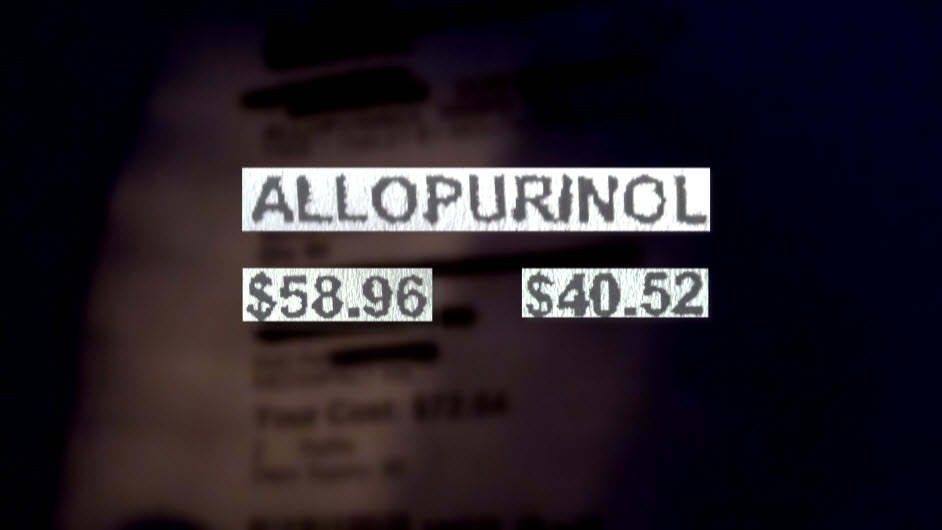

Another example: Allopurinol, for kidney stones:

- $58.96 with the insurance copay.

- $40.52 if you paid cash.

We showed Doug Hoey other examples we found, including one for the common antibiotic Doxycycline.

The copay was $46.14. The cash price was just $26.95.

“My son needed the exact same drug and the exact same thing happened," Hoey told us. "Fortunately, I knew to ask, and I got the much less expensive price."

But, too often, customers don’t know to ask. And, believe it or not, pharmacists aren’t supposed to tell them.

“GAG CLAUSES” KEEP CUSTOMERS IN THE DARK

“They have these gag clauses that forbid them from talking to consumers,” Hoey explained.

Gag clauses like the one in a contract obtained by KARE 11 detail how pharmacists can get kicked out of an insurance network if they talk to the media or “sponsor’s members” – which means customers – “without prior consent.”

That explains why pharmacists are frightened about speaking out about insurance overcharges.

“By me giving this information out, you know, I’m risking losing my contract,” said a pharmacist who agreed to speak to KARE 11’s Jay Olstad on the condition that we not use his name.

Jay Olstad: “What would happen if you were kicked out of the network?"

Pharmacist: “I mean it would literally shut the doors. It would be over.”

Those threats of retaliation even have Congress asking questions.

“If you make too much noise about this, your contract could be in jeopardy?” asked Congressman Doug Collins (R-GA) during a recent hearing. “That is not right."

WHERE’S THE MONEY GOING?

So, if consumers are paying more for prescriptions, who's getting the extra money?

That’s what KARE 11’s Jay Olstad wanted to know when he interviewed Doug Hoey of the National Community Pharmacists Association.

Olstad: "Does it go to the local pharmacies?”

Hoey: “It certainly does not go to the local pharmacies.”

In fact, Hoey says Pharmacy Benefit Managers (PBMs) and insurance companies use so-called “clawbacks” to pocket the extra money.

He says “clawbacks” are when PBMs tell local pharmacies to collect a copay, but require them to return much of that money to the insurance plan.

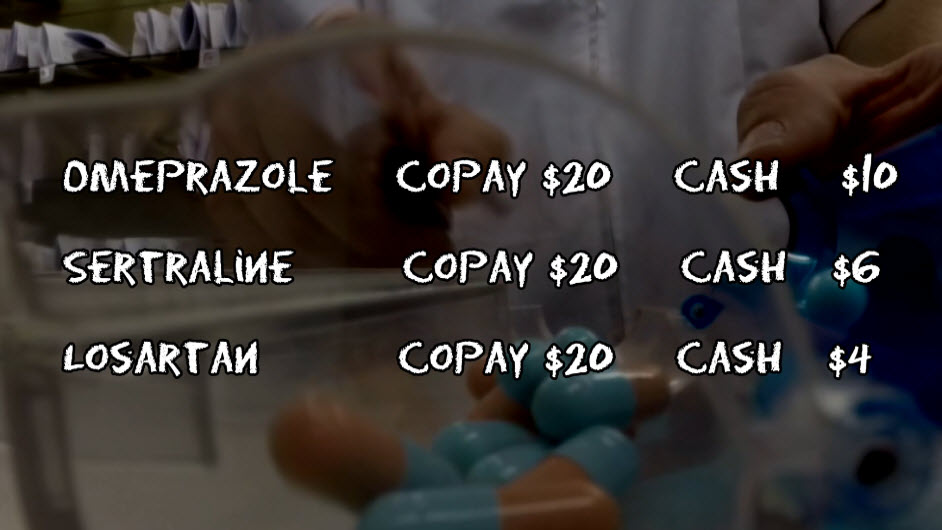

A current pharmacist gave KARE 11 an example of how the “clawback” process works.

“A clawback is what they’re referred to,” he explained. “An insurance company may charge the patient, say, $20 in a copay. But then they ‘clawback’ $16. So the pharmacy ends up with a net $4.”

WHO’S PROFITING FROM CLAWBACKS?

So, who’s cashing in from prescription clawbacks? Doug Hoey says two companies with Minnesota connections are.

“Optum and Catamaran are the two who most frequently use the consumer clawback tactic,” he said.

And who are those companies owned by?

“They're owned by United Health, which obviously has a big presence here in the Twin Cities," Hoey said.

In fact, KARE 11’s investigation documented examples in which customers purchasing prescriptions through UnitedHealth Group companies, to treat conditions including heartburn, depression and high blood pressure, were charged more in copays than they would have if they’d simply paid cash.

CLASS-ACTION LAWSUITS FILED

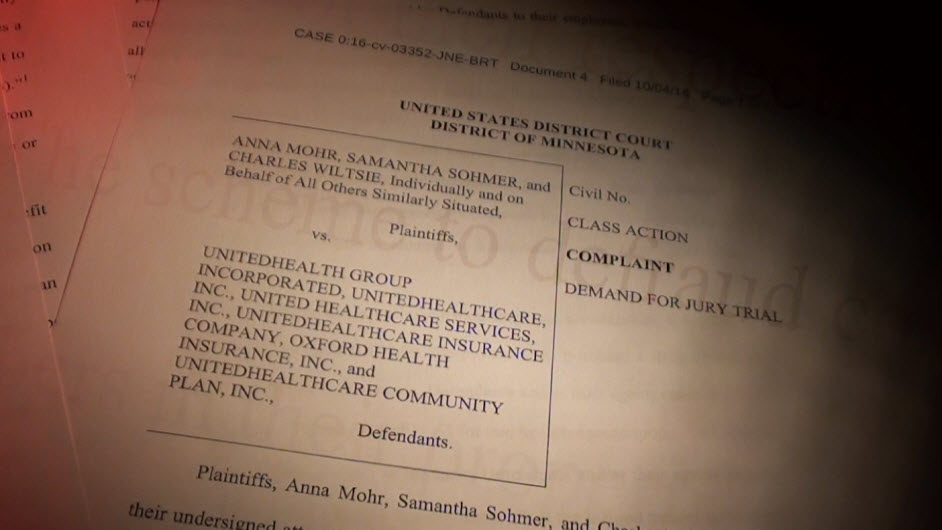

Two class-action lawsuits filed just last month accuse UnitedHealth Group of a “scheme to defraud” customers in connection with prescription copay pricing.

The lawsuits claim UnitedHealth Group and its related companies used “gag clauses” to try to keep its so-called “clawback scheme” secret.

KARE 11 asked to sit down with representatives from UnitedHealth Group for an on-camera interview about allegations that the company had overcharged customers.

UnitedHealth Group declined our request. In emails, the company said the lawsuit “has no merit.”

“Our pharmacy offerings will help customers and consumers save billions in prescription drug costs this year alone. Pharmacies should always charge our members the lowest amount outlined under their plan when filling prescriptions,” UnitedHealth Group said in a statement.

They added, that customers should never pay more than the cash price. But the email didn’t explain why some copays did cost more than just paying cash.

Retired pharmacist Tim Gallagher thinks consumers should demand changes.

"People are getting taken advantage of, pharmacies are getting underpaid, and the PBMs are laughing all the way to the bank,” he said.

Here’s the tough part for insurance customers. Paying cash may not always save you money because experts say those purchases generally don't count toward your insurance deductible.

HOW TO COMPARE PRICES

If you do want to consider paying cash, consumer advocates recommend shopping around.

Consumer Reports posted an article earlier this year with tips about finding the best prescription drug prices.

They recommend always asking your pharmacist, “Is this your lowest price?”

In addition, there are a number of private websites that allow you to check prescription prices and to find discount coupons at pharmacies in your area. Two of them are GoodRX.com and Lowestmed.com.

If you discover your insurance copay is more expensive than the cash price for the same prescription, we’ll like to hear about it. You can email us at investigations@kare11.com.