MINNEAPOLIS, Minnesota — An eight-year journey is paying off.

"If you know that you might be able to help solve the problem, you can't walk away," said Debra Hurston, executive director of the Association for Black Economic Power (ABEP).

The organization started in July 2016 in the wake of several police killings, including the death of Philando Castile. ABEP's main goal was establishing a Black-led community credit union in north Minneapolis.

"There was a huge need. I've said it once and I'll say it a million times, no cavalry was coming. It was a banking desert and the financial institutions that were there were having a hostile relationship with the communities riddled with payday lenders. So people were left to become victims to payday lenders raking over 400% on a loan," said Hurston, who joined ABEP in December 2020.

According to an analysis by the Federal Reserve Bank of Minneapolis using data from the Home Mortgage Disclosure Act, an applicant of color is more likely to have their application denied than a white applicant with the same income and credit score when applying for a conventional mortgage of the same size for a similar home.

"We decided to come up with a solution and that's the credit union," Hurston said.

Arise Community Credit Union is the first new state-chartered credit union in Minnesota in 23 years and the first Black-led credit union in the state's history.

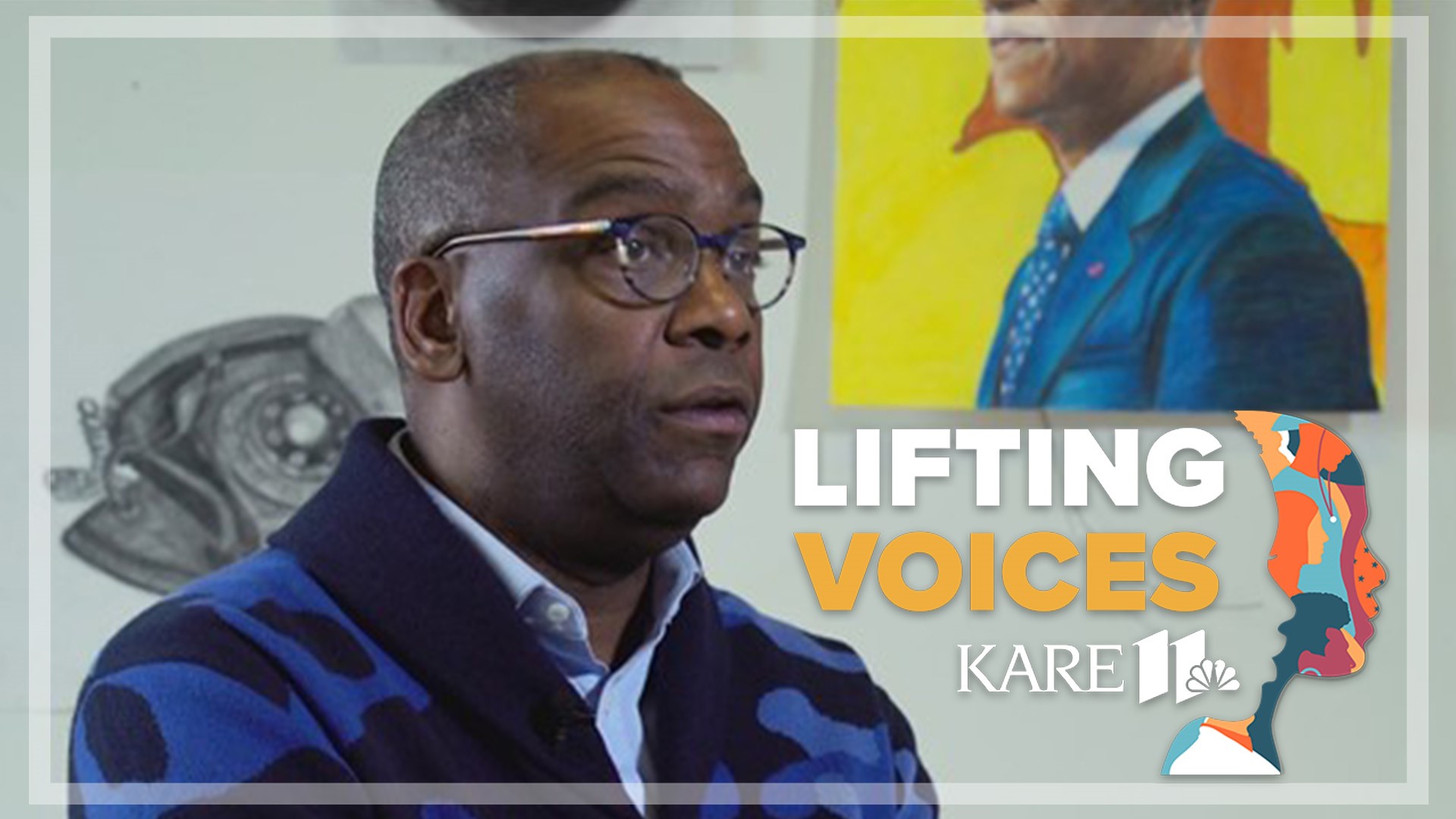

"Credit unions, they're nonprofit. So what happens is we still make money. But what happens when we make money, our members pay less interest and earn higher interest. So we put it back into the bank so that we can offer that to our members," explained Daniel Johnson, CEO-designee for Arise Community Credit Union.

Johnson has more than 20 years of experience in banking.

"We love all and serve all, so we're going to love and serve everyone. However, we're going to really make a concerted effort to reach toward the communities and groups that have been left, before us, behind," Johnson said.

"It's a good way to build trust in the community," said Aeton de Long-Hersh, Minnesota Department of Commerce chief examiner for state-chartered credit unions.

De Long-Hersh said credit unions can be either federally or state-chartered.

"How it really works in Minnesota is it's a dual-chartered option. The state-chartered credit unions are regulated by the Minnesota Department of Commerce, but insured by NCUA (National Credit Union Administration). The federal-chartered credit unions are both regulated and insured by NCUA," de Long-Hersh explained.

Currently, 70% of the credit unions in Minnesota are state-chartered. There are 61 state-chartered credit unions and 87 total credit unions in Minnesota.

"Department of Commerce, we regulate credit unions. But what that really means is we want to ensure that credit unions are safe and sound but also they have a good strategic plan in place to ensure that they're viable into the future... we're there to help them," de Long-Hersh said.

Arise will be a not-for-profit cooperative owned by members within Hennepin and Ramsey Counties. They will offer more services in phases, starting with the basics like checking and savings accounts and consumer loans.

In the beginning, it will be online banking only. But the goal is to open a brick-and-mortar location in north Minneapolis.

They also plan on holding events around financial literacy.

Arise Community Credit Union expects to be signing up its first members by the end of the year. Johnson has already said Hurston will be their first member.

Arise will be holding an event to celebrate on March 28 at 5:30 p.m. at Shiloh Temple in Minneapolis.

Watch more Breaking The News:

Watch all of the latest stories from Breaking The News in our YouTube playlist: