ST PAUL, Minn. — In its first round of medical debt relief, the city of Saint Paul wiped out nearly $40 million of debt for 32,000 people.

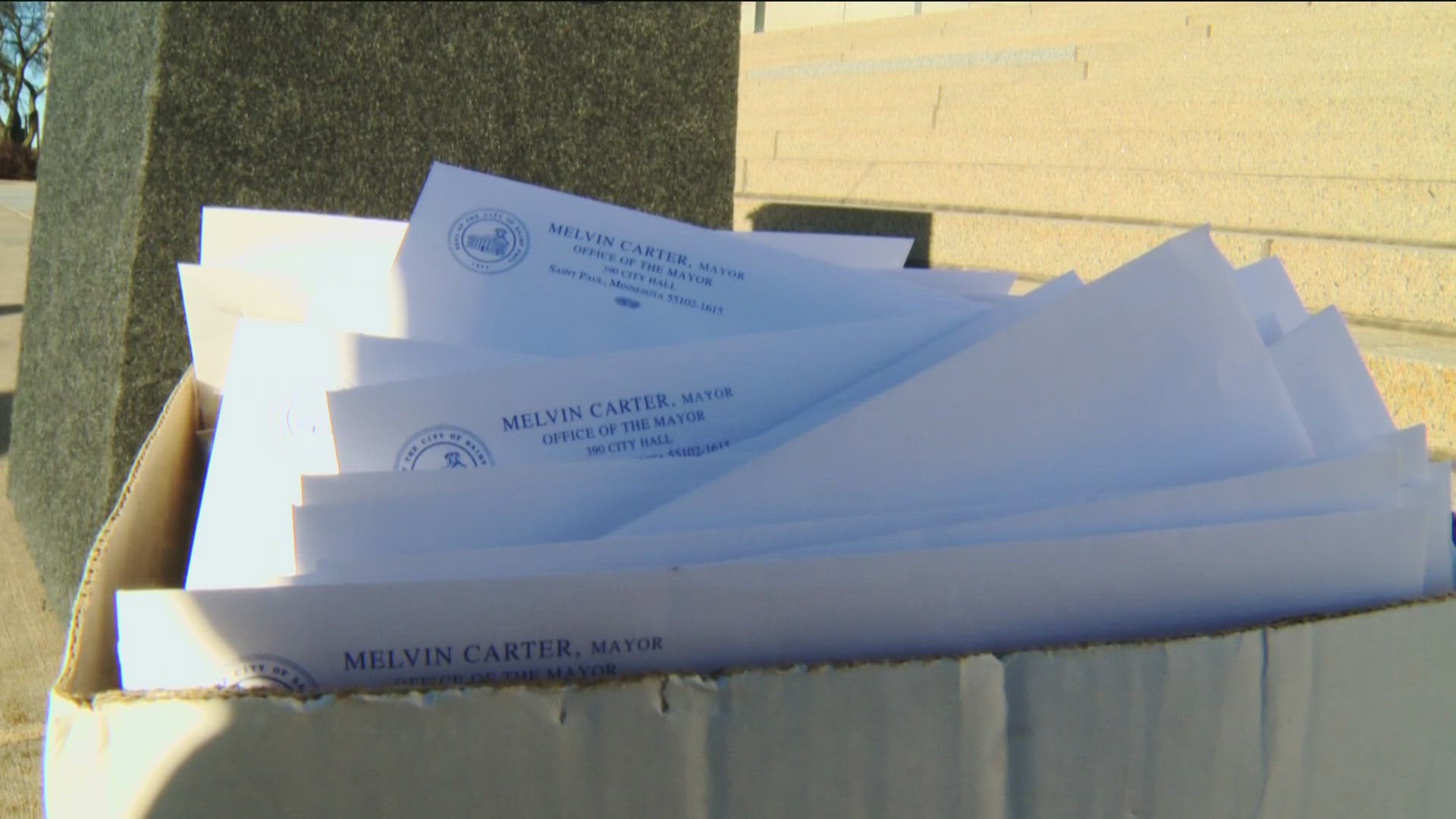

"Residents will receive a surprise notice in the mail that their medical debts totaling just shy of $40 million have been purchased by the city and completely abolished," Saint Paul mayor Melvin Carter announced in a press conference on Tuesday. "Every day, millions of Americans face the impossible choice between paying medical bills and covering their basic needs. Nearly half of all bankruptcies are linked to medical debt and nearly 50% of adults have delayed or skipped care due to debt."

According to the Kaiser Family Foundation, an analysis of government data shows Americans across the country owe at least $220 million in medical debt. In Minnesota, the organization estimates about 330,000 people have medical debt.

Under Carter's Medical Debt Reset Initiative, the city of Saint Paul is using funds from the American Rescue Plan to cancel roughly $110 million in medical debt for people who meet certain income requirements.

There is no method of applying for forgiveness. People who meet the required criteria are automatically considered for debt relief.

The city is partnering with the national nonprofit organization, Undue Medical Debt, to buy and cancel debt from local healthcare facilities. Fairview patients were the first to get their debts forgiven in this round.

"Last year, we shared that all of our major hospital systems in the state have signed on to do this with us," Carter explained. "So, Fairview has gone first and we expect the rest to follow shortly."

"There's no reason why this should stop at Saint Paul," Minnesota Attorney General Keith Ellison said. "There's no reason why this policy should not be extended throughout the state of Minnesota because Minnesotans, in fact, are struggling under the weight of medical debt. Medical debt they did not ask for, they did not plan for."

Walt Myers, a lifelong Minnesota resident, veteran and cancer survivor, said he knows what it's like to "be under a cloud of medical debt." After his wife Sue passed away from breast cancer five years ago, Myers said he began to receive medical bills for his late wife's in-home hospice care. The bills began to accumulate and far surpassed the maximum $4,000 out-of-pocket expenses he was prepared to pay under his medical plan.

"I felt very lost in the medical billing hell that I found myself in," Myers said.

He soon began working with Cancer Legal Care, an organization dedicated to assisting cancer patients and survivors with any legal needs.

"With the help of my former employer, we came up with a possible solution that we thought might work," Myers recalled. "We contested the charges and then we waited. After almost a month of waiting, we heard back from the insurance company, and what ultimately turned out to be $135,000 dollars of medical debt had entirely been forgiven. Every penny, it was gone."

Myers said he was stunned. "I was incredibly relieved and I don't know how else to describe this, but to me, it was a life-changing event," he said. "Maybe as a result of all of this, we'll be able to hear a few more life-changing stories."

The average amount of debt forgiven per person is $268, according to the mayor's office. The largest amount canceled during this round of relief is $105,000.