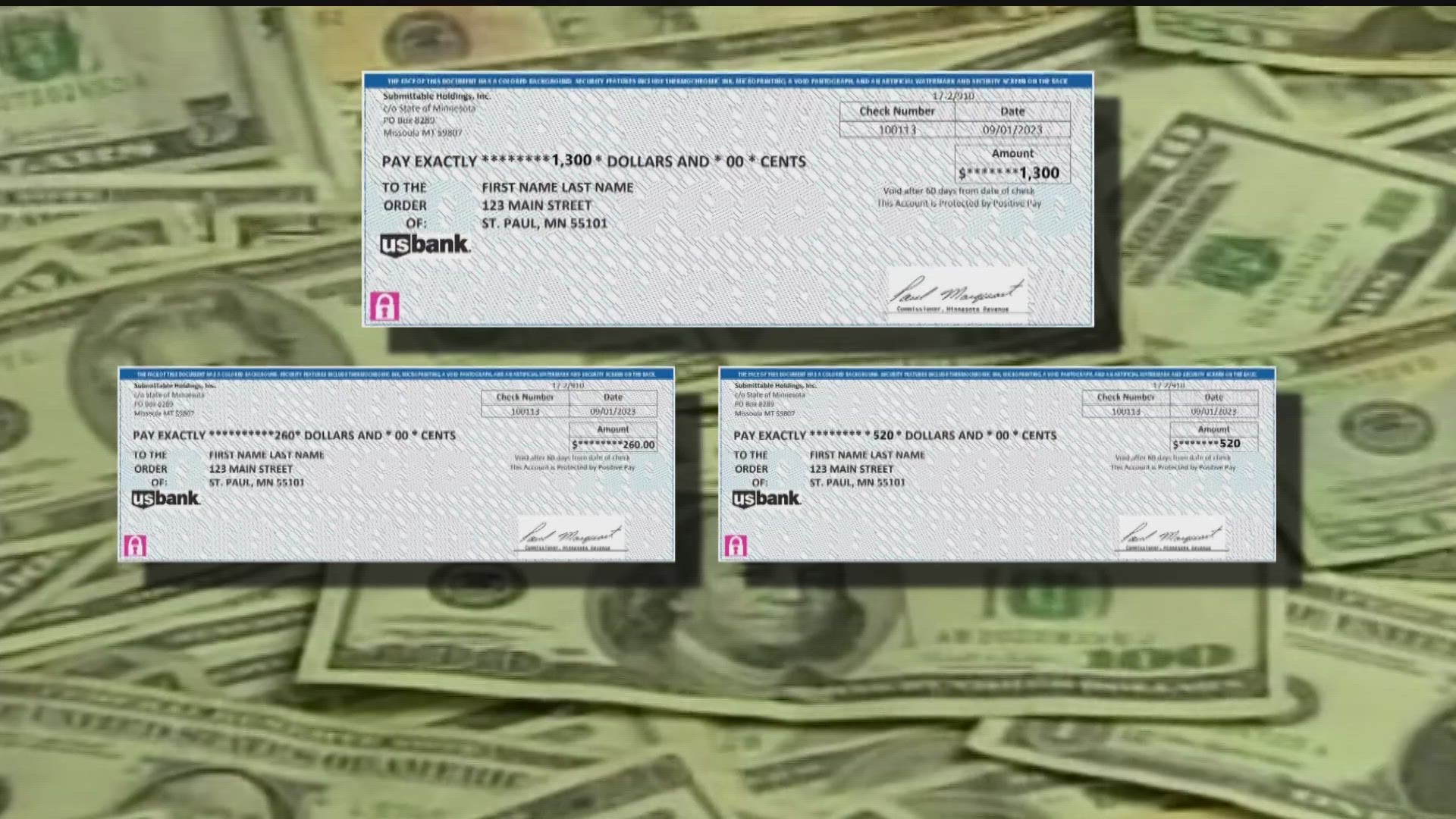

ST PAUL, Minn — It's been about a month since Minnesotans began receiving one-time tax rebate payments, which were approved in the last legislative session out of the state's multi-billion dollar budget surplus. While some taxpayers had the money directly deposited into their bank accounts, many received checks in the mail from Montana-based Submittable Holdings, Inc.

Despite coming from out-of-state, the Minnesota Department of Revenue confirmed Tuesday that these are legitimate checks from a company the state partnered with to help distribute the money.

"Revenue used a third party because we are in the middle of property tax refund season, and the department does not have the resources needed to issue both payments without risking an interruption to property tax refunds," said Ryan Brown with the state revenue department. "We understand many taxpayers rely on timely property tax refunds to pay their October property tax bill, so it's vital there is no interruption."

The state has also partnered with U.S. Bank, which, along with Submittable, has been vetted and approved to work with the state, according to Brown.

Minnesotans who have not yet received their one-time payment shouldn't need to do anything to get their money. According to state officials, the money will automatically be sent by direct deposit or check based on 2021 income tax returns. The one exception is if you've moved or changed bank accounts since filing your 2021 return and missed the July deadline to update your information with the state.

Here's everything you need to know about the checks:

Who's eligible for a tax rebate payment?

Anyone who lived in Minnesota in 2021 and filed an income tax return or property tax refund is eligible as long as they meet the limits on adjusted gross income in their 2021 tax return ($75,000 or less for single filers, $150,000 or less for married couples who filed together).

Who isn't eligible?

Taxpayers who exceed the adjusted gross income limits, those claimed as dependents, and taxpayers who died before Jan. 1, 2023.

How do I apply?

You don't need to apply. There is no application or form to fill out; rebates will be sent automatically based on income tax returns for tax year 2021, including the adjusted gross income amount, mailing address, and direct deposit information if provided.

How much will I receive?

- $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021

- $520 for married couples who filed jointly with an adjusted gross income of $150,000 or less in 2021

- $260 each for up to three dependents, if taxpayers met the adjusted gross income requirements; that could mean a maximum check of $1,300 for married couples with three dependents.

When will I receive the payment?

Payments will be processed and are now starting to arrive in bank accounts.

What if I still have questions?

More information can be found on the Minnesota Department of Revenue's website.

Watch more local news:

Watch the latest local news from the Twin Cities and across Minnesota in our YouTube playlist: