ST PAUL, Minn. — Minnesota taxpayers will get a small boost in their bank accounts this fall with one-time tax rebate payments, thanks to the state's multi-billion dollar budget surplus.

The rebates were approved as part of the state budget passed by the legislature and signed by Gov. Tim Walz. You might have heard the governor or others in his administration refer to them as "Walz checks," though that is not the official name.

Most taxpayers won't need to do anything to receive the payments. The money will be automatically sent by direct deposit or mailed by check based on 2021 income tax returns. However, Minnesotans who have changed addresses or bank account numbers will need to update their information with the state by July 28 to get a payment.

Here's everything you need to know to make sure you get your payment:

Who's eligible for a tax rebate payment?

Anyone who lived in Minnesota in 2021 and filed an income tax return or property tax refund is eligible as long as they meet the limits on adjusted gross income in their 2021 tax return ($75,000 or less for single filers, $150,000 or less for married couples who filed together).

Who isn't eligible?

Taxpayers who exceed the adjusted gross income limits, those claimed as dependents, and taxpayers who died before Jan. 1, 2023.

How do I apply?

You don't need to apply. There is no application or form to fill out; rebates will be sent automatically based on income tax returns for tax year 2021, including the adjusted gross income amount, mailing address, and direct deposit information if provided.

How do I make sure my information is up-to-date?

If your address or bank account information has changed since your 2021 tax return, you'll need to let the state know. Visit a special online portal at taxrebate.mn.gov and update your information by 5 p.m. on July 28, 2023.

How much will I receive?

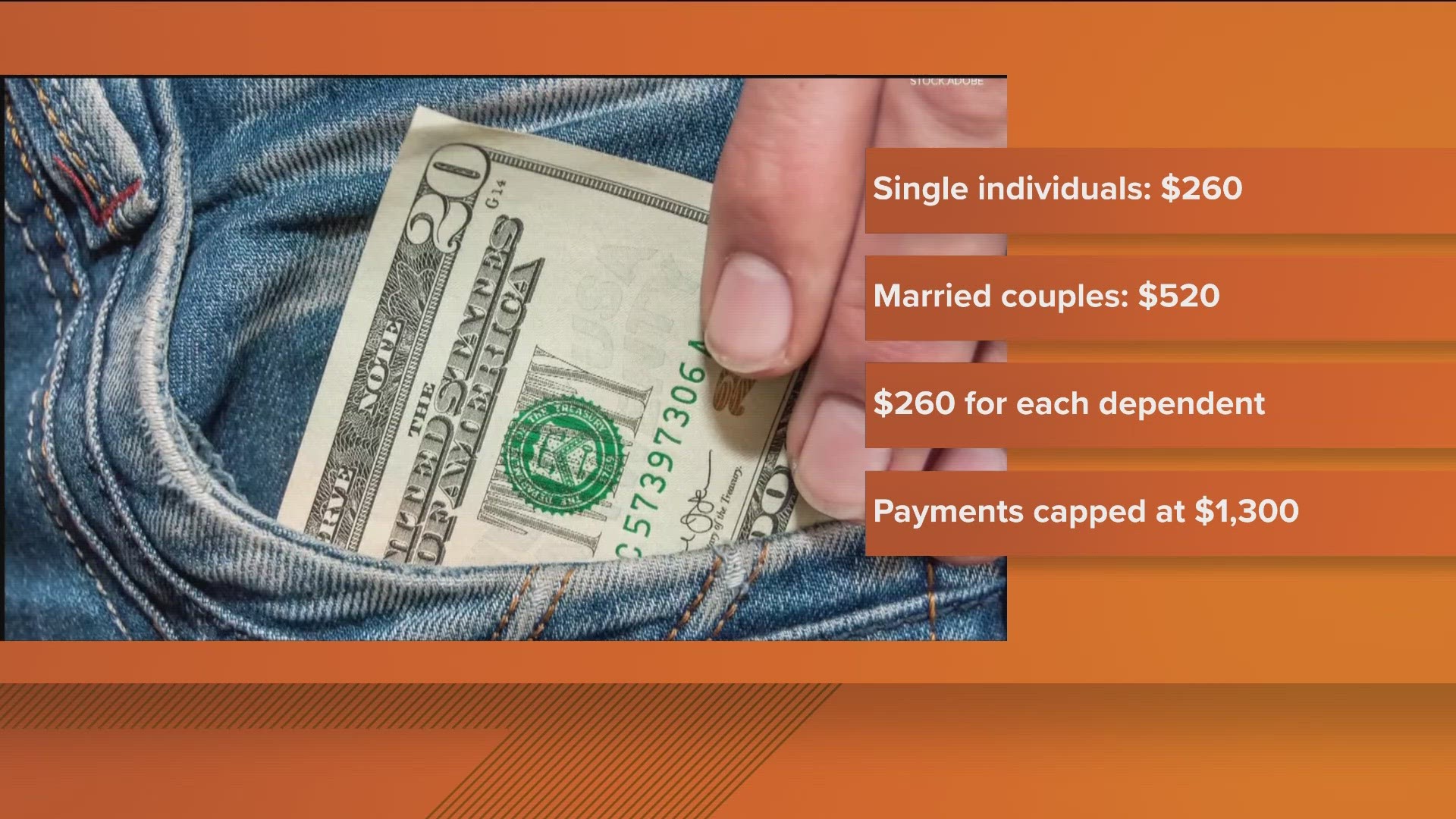

- $260 for each taxpayer with an adjusted gross income of $75,000 or less in 2021

- $520 for married couples who filed jointly with an adjusted gross income of $150,000 or less in 2021

- $260 each for up to three dependents, if taxpayers met the adjusted gross income requirements

When will I receive the payment?

Payments will be processed and sent out this fall, though an exact date has not been released as of July.

What if I still have questions?

More information can be found on the Minnesota Department of Revenue's website.

Watch more local news:

Watch the latest local news from the Twin Cities and across Minnesota in our YouTube playlist:

WATCH MORE ON KARE 11+

Download the free KARE 11+ app for Roku, Fire TV, Apple TV and other smart TV platforms to watch more from KARE 11 anytime! The KARE 11+ app includes live streams of all of KARE 11's newscasts. You'll also find on-demand replays of newscasts; the latest from KARE 11 Investigates, Breaking the News and the Land of 10,000 Stories; exclusive programs like Verify and HeartThreads; and Minnesota sports talk from our partners at Locked On Minnesota.

- Add KARE 11+ on Roku here or by searching for KARE 11 in the Roku Channel Store.

- Add KARE 11+ on Fire TV here or by searching for KARE 11 in the Amazon App Store.

- Learn more about the KARE 11+ app for Apple TV in the Apple App Store.

- Learn more about KARE 11+ here.