ST PAUL, Minn. — By State Capitol standards, the Minnesota tax conformity bill came together at lightning speed, making it to the governor's desk just nine days into the 2023 Session.

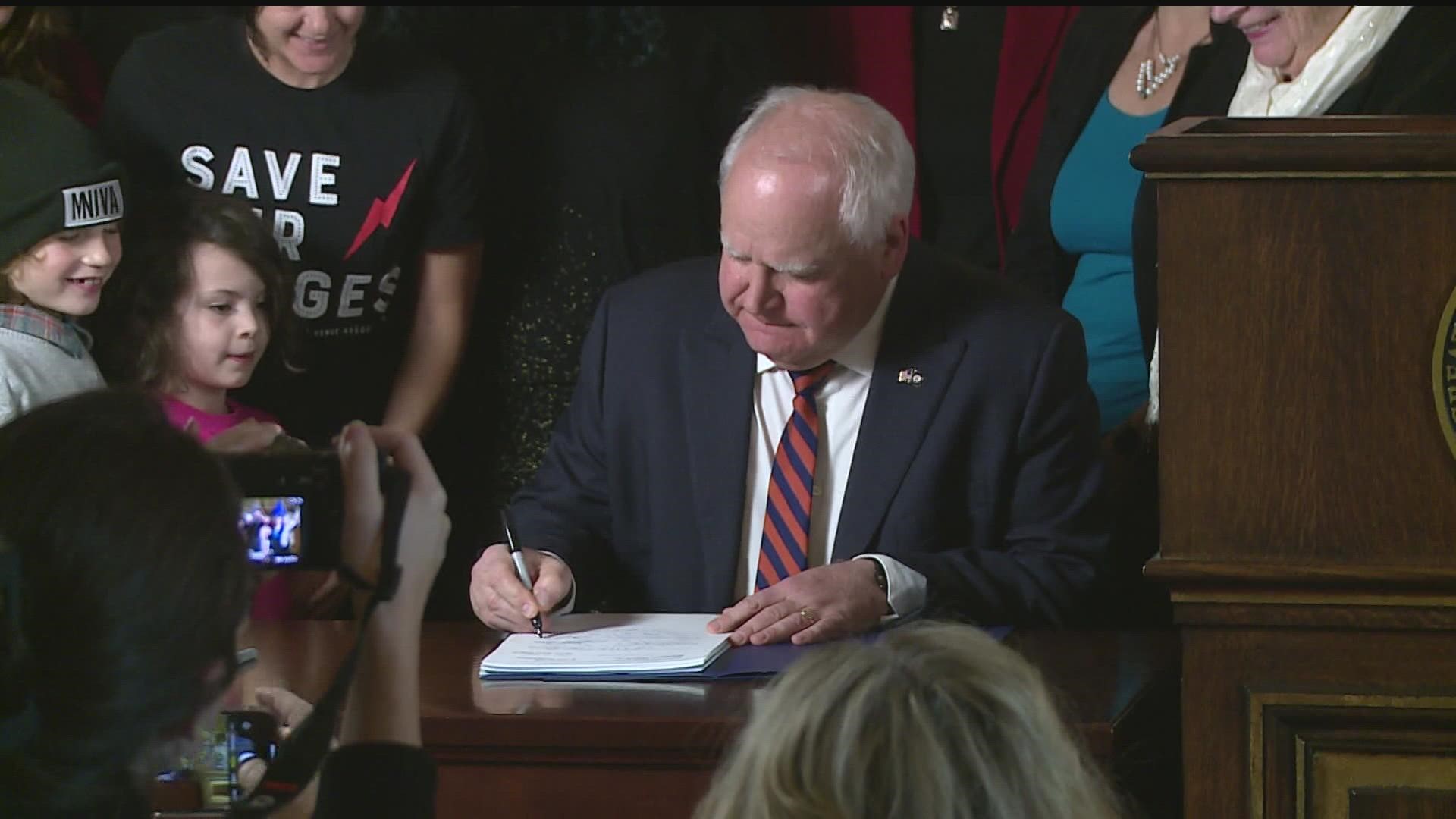

In the simplest terms, it will line up the Minnesota tax code with Uncle Sam's, something that's often easier said than done. When Gov. Tim Walz signed it into law Thursday, it marked the earliest tax conformity measure in state history.

And, more importantly, it happened in time for tax forms to be updated before the 2022 tax filing season begins January 23. Revenue Commissioner Paul Marquart, who served as House Tax Committee chair during his time in the legislature, was beaming at Thursday's signing ceremony.

"As soon as that bill gets signed the buttons are going to be pushed and the new 2022 updated forms will be on the Department of Revenue website!" he said.

The bipartisan bill will make it simpler to file 2022 state and federal income tax returns. The Dept. of Revenue estimated that lining up the state and federal tax credits, subtractions and exemptions will deliver $100 million in tax relief to 600,000 Minnesota tax filers.

"To get this done today and the work they did just makes things simpler, gets our forms done right, gets these things out and make sure people can file their taxes on time and pay with a fair amount," Walz said.

Among those eagerly awaiting action for the legislature were entertainment venues that, thanks to this bill, won't be required to pay state income taxes on COVID-related federal relief money. Those who already paid taxes on those federal benefits will be able to file amended returns to reclaim that money.

"Minnesota’s small venues, movie theaters, restaurants -- those of us that were the first to close and the last to reopen -- can breathe a giant sigh of relief," Dayna Frank, the CEO of First Avenue, told reporters.

"The tax would've been 10 to 11 percent of our total grant money and all the grant money was spent. There were no leftover funds to pay a 10 or 11 percent tax liability."

The feeling was the same from the beleaguered hospitality industry, which includes restaurants, hotels and resorts.

"Our survey found during the height of the pandemic over 66% of restaurants took on debt, and it was over $500,000 dollars each they took on," Liz Rammer of Hospitality Minnesota explained.

"So, this is an opportunity for them to refill those coffers and help them with their staffing. We know with inflation, the supply chain, all things still buffeting them. This is going to help."

Tax conformity will also make it easier for Minnesotans to accept college student loan forgiveness from the federal government. Without this bill, there was a chance student debt forgiveness would be counted a federal benefit and subject to state income taxes.

"I paid off my student loans my first term as lieutenant governor, so I am excited this bill will provide some long-awaited relief to past, present and future students here in our state," Lt. Gov. Peggy Flanagan remarked.

Rep. Aisha Gomez, the Minnesota Democrat who now chairs the House Tax Committee, said she's still trying to pay off those debts.

"Lt. Gov. Flanagan paid her student loans off. I'm still working on mine," Rep. Gomez told reporters.

"We all know this student debt crisis is still hitting people like me, and I have a 10-year-old son and parents who are aging."