ST PAUL, Minn. — The message from Minnesota Democrats Friday was simple and blunt: eliminating Minnesota’s personal income tax would leave a $15 billion hole in the state’s annual budget, which would imperil schools, nursing homes, and other state budget priorities.

DFL lawmakers and others appeared at the State Capitol on behalf of the Gov. Tim Walz’s re-election campaign, to sound the alarm about the idea floated by the governor’s Republican challenger Dr. Scott Jensen.

“Removing the income tax may sound good on a bumper sticker during an election campaign, but it will have a devastating effect on our economy,” remarked Rep. Cheryl Youakim, the Hopkins Democrat who chairs the Property Tax Division of the House Tax Committee.

Rep. Youakim pointed out the state income tax accounts for 47% of all the revenue collected by the state each year. The second largest slice of the money pie comes from the statewide sales tax, which amounts to 28% of all the money collected by the Minnesota Dept. of Revenue.

Jensen's pitch

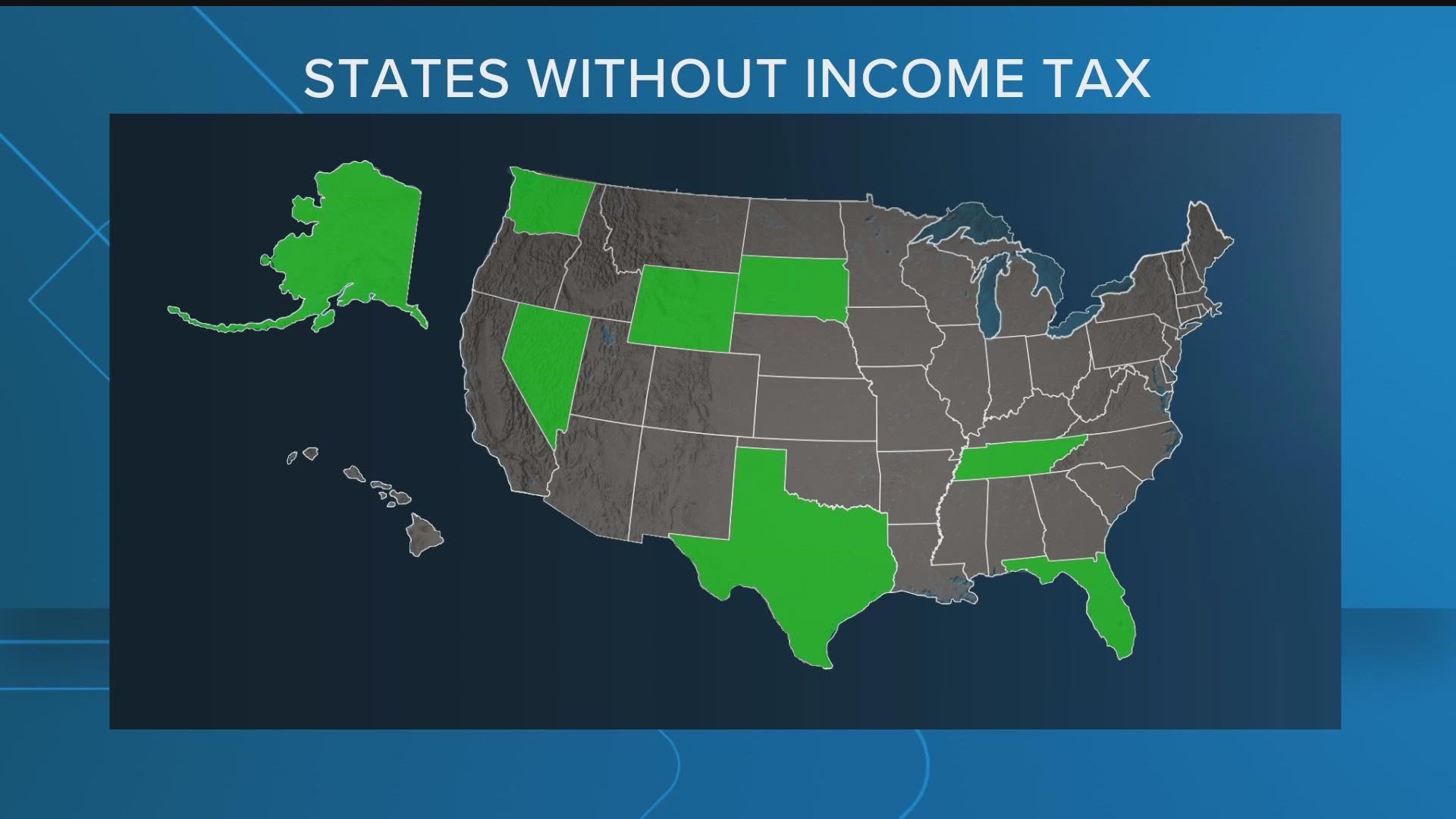

Jensen talked about the idea in at a press conference last June when he rolled out his plan for easing inflation on consumers and wage earners. He mentioned that eight other states have learned to do without a state personal income tax.

“We have to increase worker pay and one way to do that is either to eliminate, phase out, or dramatically reduce our personal income tax,” Jensen told reporters.

“Have Minnesotans asked themselves what we would look like if we lost Arctic Cat, Polaris, JDS, if we lost Target? If we lost Best Buy?”

He was echoing a warning Republicans have issued for many years, that our high taxes create the risk of losing major industries to places with lower taxes.

Sen. Kari Dziedzic, a Minneapolis Democrat who serves on the Senate Tax Committee, asserted that Minnesota employers benefit from having a well-educated workforce and other public amenities.

“Minnesota ranks very high in quality of life, and the money we put in those incomes taxes pay for services.”

The Jensen campaign issued a statement Friday calling it a desperate move, and chided Gov. Walz for sending surrogates to talk about the issue.

Minnesota’s tax rates

Minnesota's top rate of 9.85% landed the state in the list of the top ten highest income tax rates in the nation. But it’s important to note that 9.85% rate applies only to that part of your income above $284,000 per year for joint filers or $171,000 for single filers. Progressively lower rates – 7.8% 6.8% and 5.3% -- apply to lower tiers of your earnings.

Cutting the lowest rate was a priority of Senate Republicans in the 2022 legislative session, as a response to the state’s projected $9 billion budget surplus. Gov. Walz and Democratic legislative leaders had agreed to a small cut in the tax rate at one stage in negotiations, but those talks eventually fell through. The session ended without a supplemental tax bill.

States without personal income taxes include Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming.

Some have floated the idea of making up for loss by applying a sales tax to groceries and clothing, which currently are tax-exempt in MInnesota. Democrats have traditionally opposed that because those taxes would fall hardest on lower income Minnesotans. They also point out those sales taxes would raise roughly $1 billion per year in new revenue, far short of the $15 billion generated by current income tax rates.

Jensen calls his idea aspirational, about taking bold steps to rein in excessive government spending and deliver some relief to family pocketbooks, as such a plan would need to be phased in over at least eight years, he maintains.

When asked by a reporter in June whether it’s realistic to talk about totally eliminating the income tax, Jensen said skeptics once doubted Thomas Edison could create a functioning electric light bulb.

“It is realistic to talk about eliminating Minnesota’s personal income tax? I think it's as realistic as inventing a light bulb or a computer on my phone that used to take up a room this size with mainframes.”