ST PAUL, Minn. — The Minnesota House has passed a bill to replenish the state's unemployment insurance trust fund and get bonuses to frontline workers, in a potential breakthrough after months of stalemate.

The bill passed late Monday includes $2.7 billion to replenish the unemployment insurance trust fund and pay back the federal government for jobless aid, and Democrats’ $1 billion proposal for $1,500 checks for workers who took risks during the pandemic. It would also make hourly school workers eligible for unemployment benefits during the summer months.

House Democratic and Senate Republican leaders, along with Democratic Gov. Tim Walz, spent months trying to agree terms but leaders failed to reach a deal by a March 15 deadline, triggering an automatic payroll tax hike on Minnesota employers.

Under the new legislation, employers who paid their tax bills before the April 30 due date would get a refund. House Democrats also included the full $2.7 billion that Senate Republicans and Walz said was needed to refill the trust fund, instead of the $1.2 billion that House Democrats have long insisted would be sufficient.

It passed on a 70-63 vote.

The bill now goes to the Senate, which passed its own bill in February on a bipartisan 55-11 vote. That version did not include bonuses or unemployment benefits for school workers. Both sides voted last year to earmark $250 million in “hero pay” for frontline workers but couldn’t agree on how to parcel it out.

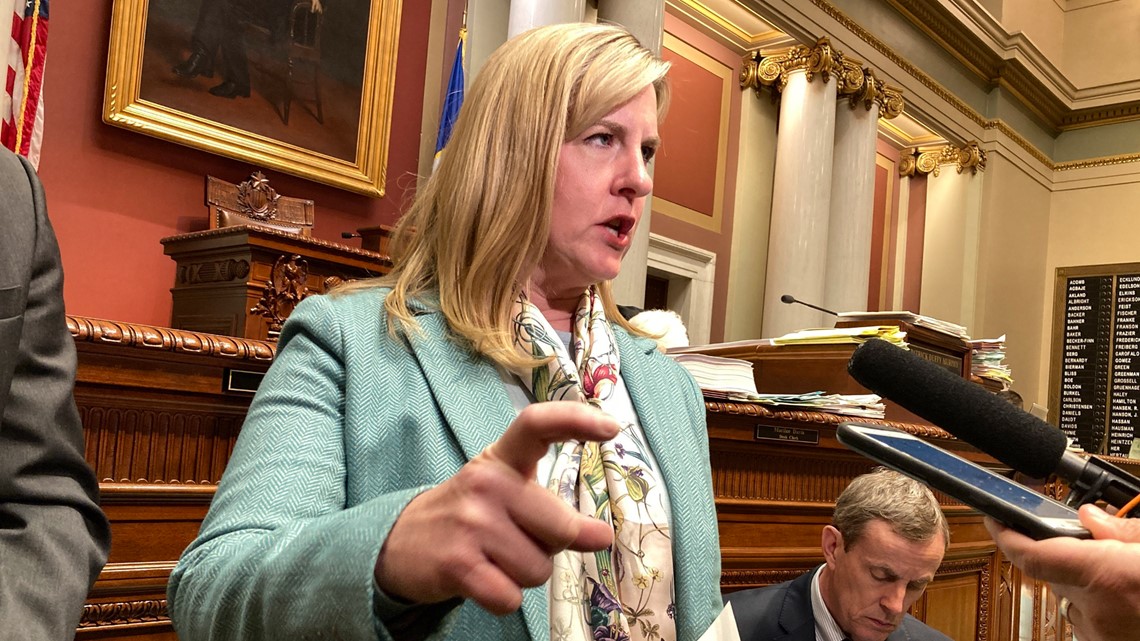

“Our highest priority is ensuring that workers who were on the front lines during COVID-19 receive the bonus pay they deserve,” Democratic House Speaker Melissa Hortman, of Brooklyn Park, said in a statement. “Governing in a divided Legislature requires give and take from both sides, and it is time for the Senate GOP to join us in our efforts to resolve these issues.”

Walz asked lawmakers to reach a compromise during his State of the State address Sunday night, saying the issues should have been resolved in January.

Republican lawmakers argued the unemployment insurance fix should have been passed on its own, citing the April 30 deadline for businesses to pay the quarterly tax bills affected by the hike. Given the differences between the two bills, a House-Senate conference committee was appointed to reconcile them.

For updates on when to start applying for the payout, click here.

Watch more Minnesota politics:

Watch the latest political coverage from the Land of 10,000 Lakes in our YouTube playlist: