ST PAUL, Minn. — Governor Tim Walz says he is planning to meet later Monday with legislative leaders to determine whether Democrats and Republicans can bridge their differences and make a special session worthwhile.

Walz, Republican Senate Majority Leader Jeremy Miller and Democratic House Speaker Melissa Hortman agreed last week on a broad framework that called for $4 billion in tax relief, $4 billion in spending and banking $4 billion. But filling in the details before the deadline proved to be more than the divided legislature could manage.

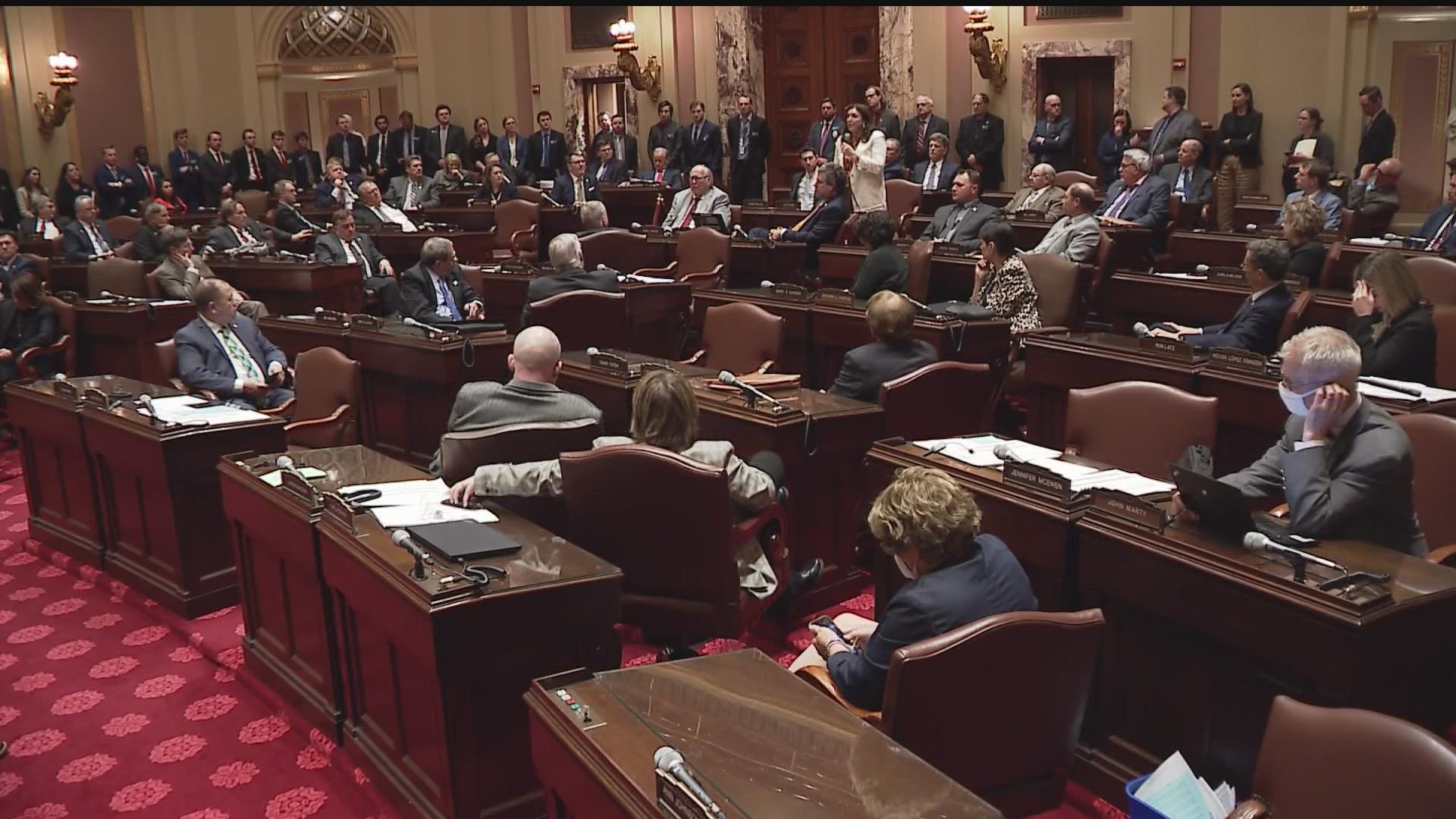

Lawmakers worked down to the final minutes of the legislative session Sunday night to wrap up the year's full docket of proposed laws but were unable to bridge significant gaps in what should go into a 2023-24 spending bill.

House leaders and Gov. Tim Walz are advocating for this important work to be finished in a special session, but the governor said he won't call one until there's an agreement on the exact language of the unpassed bills.

Senate leaders haven't committed to returning for a special session as of yet, asserting that Democrats were well aware of how much time they had but disregarded their deadlines.

A sticking point between the two parties on this issue has been what to do with the projected $9 billion surplus. The GOP wanted to pass that money back to Minnesotans in the form of tax cuts, cutting the state's first tier tax rate from 5.35% to 2.8% beginning with the current tax year. The first-tier rate would apply to the first $41,000 of a resident's income on a joint return, or the first $28,000 for single filers.

Democrats and Gov. Walz want money to be set aside for direct payments to tax payers. These "Walz Checks" would have sent a one-time payment of $500 to single payers and $1,000 to joint filers.

Earlier in May, leaders from both legislative chambers and Gov. Walz signed a compromise budget framework agreement, with $4 billion dedicated to tax cuts, $4 billion dedicated to investments in Minnesotans, and $4 billion in savings.

“The bipartisan tax agreement included a full repeal of Social Security taxes, an income tax reduction, and property tax relief for middle-class Minnesotans," said Senate Majority Leader Jeremy Miller (R-Winona) in a statement. "Not only did Democrats prevent the tax bill from getting done; they ran out the clock on other important policy initiatives."

“All session, House DFLers have been focused on reducing costs for families, supporting workers, investing in our students, and improving public safety," House Speaker Melissa Hortman said in press release. "We’ve worked with Republicans in good faith to find as many agreements as possible because Minnesotans expect us to work together, deliver results, and build a better future for everyone."

House and Senate negotiators on Saturday reached a deal on the $4 billion tax relief bill, but House leaders decided days earlier they wouldn’t bring the tax relief bill up for a vote until the spending bills were done. Since tax bills originate in the House, the Senate can’t vote on tax relief until after it passes there.

Other major bills that are still unfinished are a proposed bill that would boost special education funding by $422 million, public safety, tax relief, transportation and state government.

Both the House and Senate will meet again on Monday morning, but won't pass any bills because it is the final day of session and set aside for retirement speeches from lawmakers.

Watch the latest political coverage from the Land of 10,000 Lakes in our YouTube playlist: