ST PAUL, Minn. — Leaders of the Minnesota Senate's GOP majority proposed Thursday to give the state's projected $1.3 billion budget surplus back to taxpayers with a package of income and other permanent tax cuts, a proposal aimed more at the November elections than the current legislative session.

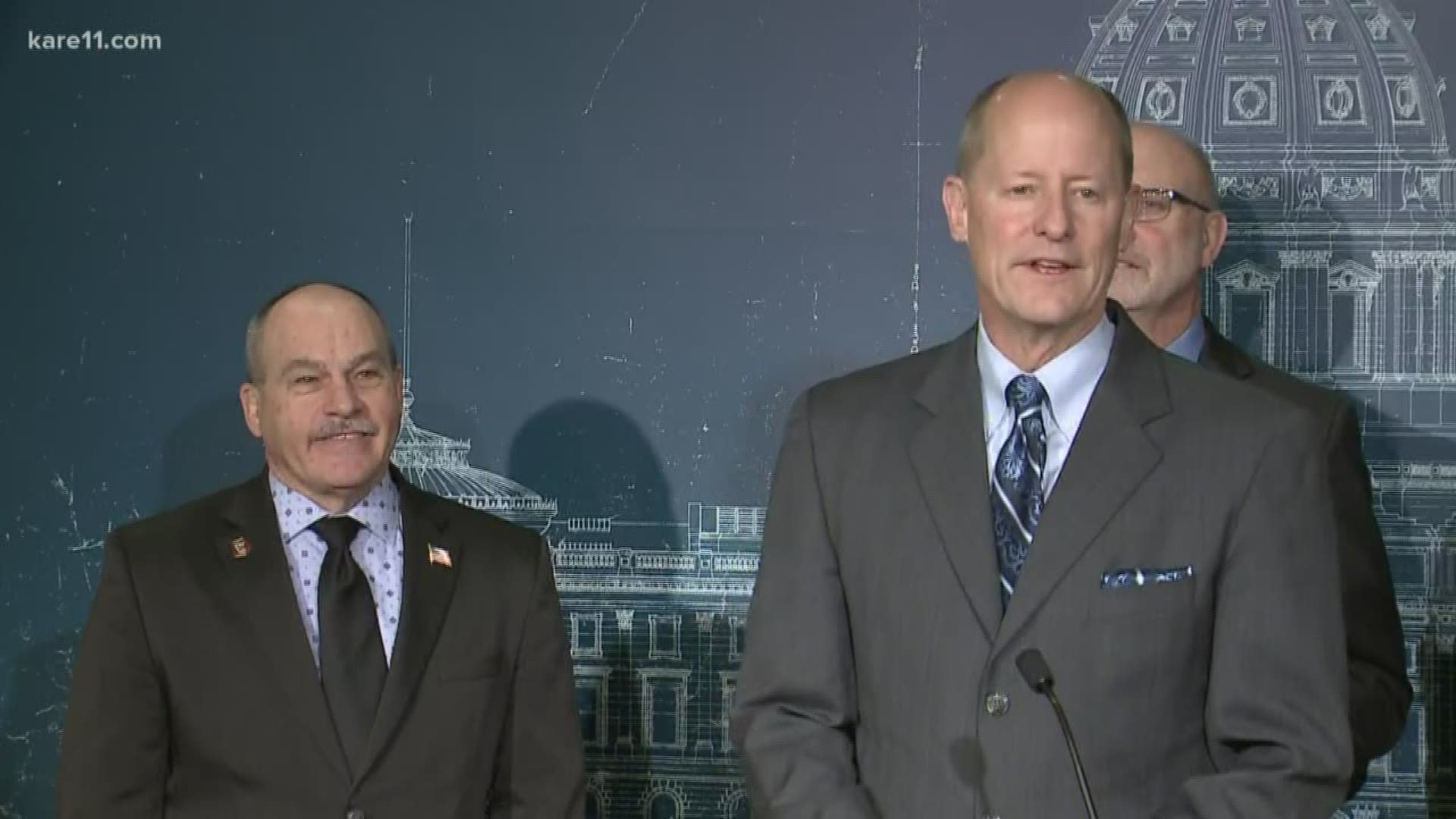

“The Democrats will hate it,” Sen. Roger Chamberlain, of Lino Lakes, who chairs Senate Tax Committee, said at a news conference.

He was right. Leaders of the House Democratic majority and the top Democrat on Chamberlain's own committee were quick to denounce the plan as fiscally irresponsible.

The centerpiece of the Senate GOP plan is a cut in income taxes for all Minnesotans by reducing the rate on the lowest bracket from 5.3% to 4.9%. That bracket currently applies to the first $39,410 of income for a married joint filer. The plan also includes a previously announced proposal to fully eliminate state income taxes on Social Security benefits, which apply primarily to upper-income Minnesotans. And the plan would expand an existing K-12 education tax credit for parents.

“The Senate Republican tax proposal is not fiscally responsible and will undermine our ability to provide good schools, good roads, and good health care for Minnesotans,” Democratic House Speaker Melissa Hortman said in a statement.

The income tax rate cut would cost the state about $440 million in lost revenue, while the Social Security change would total about $430 million, Chamberlain said. But he was short on other details about how the proposal might work and the long-term impact of the lost revenue on future budgets, given that the projected $1.3 billion surplus is one-time money and that the figure could change up or down when the state releases an updated budget forecast next Thursday.

"The numbers sing and dance, but we can make them work any way we want,” he said.

The GOP plan element with the best chance of winning bipartisan support would bring a section of the state tax code into conformity with the federal code when it comes to deductions for equipment purchases — a change that would benefit farmers and small businesses. Democratic Gov. Tim Walz and Senate and House leaders from both parties have all expressed support for that idea.

House Democratic leaders have proposed spending as much as $500 million of the surplus on a one-time bump in spending on early childhood education and child care. Walz has proposed stashing part of it in the state’s rainy day fund and using most of the rest to service the debt on his public works borrowing proposal. Those proposals could be adjusted after next week's budget update.