MINNEAPOLIS — Trump flew to Minnesota on Monday to highlight the $1.5 trillion package of corporate and individual tax cuts he signed into law in 2017.

U.S. taxpayers across the country are rushing to meet a midnight Monday deadline for filing their income tax returns with the IRS.

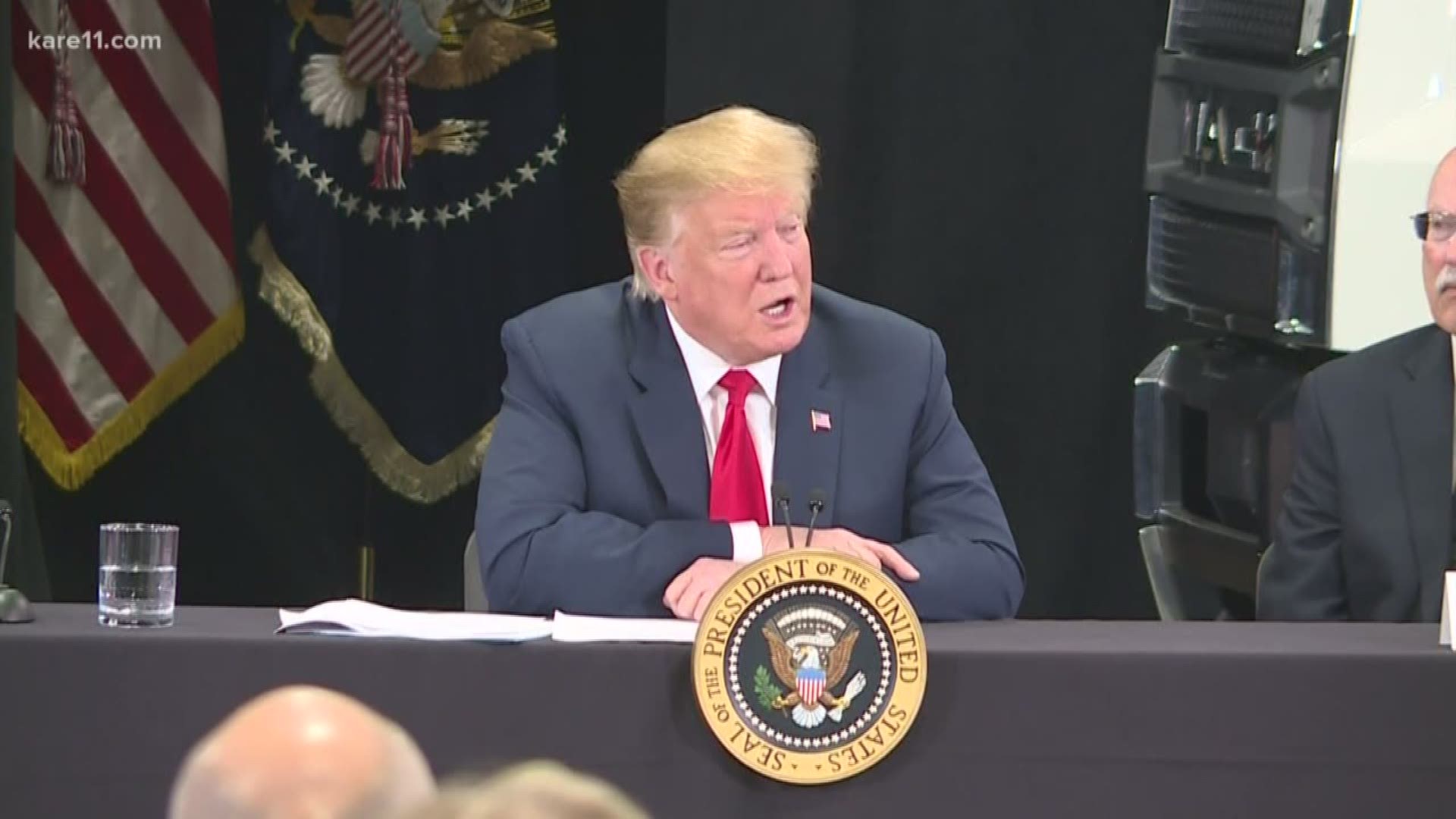

A smattering of boos rose from the audience at a trucking company in the Minneapolis suburb of Burnsville after Trump said "today is Tax Day that we're celebrating."

Trump says incorrectly that he enacted the largest package of tax cuts in history. But the facts don't bear that out.

Trump's package considerably trails Ronald Reagan's 1981 tax cuts, Barack Obama's 2013 extension of George W. Bush's tax cuts, and others.

Governor Tim Walz continued "the tradition of greeting the president" at the airport. The governor said he planned to use it as an opportunity to advocate for federal disaster aid for Minnesota.

Monday's visit is the president's third to Minnesota in less than a year. President Trump held two political rallies in 2018, but this will be his first official White House visit.

RELATED: Pres. Trump holds rally in Duluth

"This is a more intimate group with business leaders and owners to talk specifically about the economy and how the tax cuts have benefited those businesses," explained Jennifer Carnahan, chairwoman of the Republican Party of Minnesota.

The visit is also a chance to lay the groundwork for 2020. In 2016, Trump lost to Hillary Clinton in Minnesota by 1.5 percentage points. The state has not voted for a Republican for president since Richard Nixon in 1972.

"I think the president recognizes that there is an incredible opportunity to win our state's 10 electoral votes in 2020," Carnahan said. "There is certainly an opportunity to change that tide and change that momentum."

Rep. Jim Hagedorn was among those joining the President during his Minnesota visit. He says the stop underlines how important small business and tax relief are to the Trump administration.

“As a member of the House Committee on Small Business and the House Committee on Agriculture, I am sensitive to federal policy that affects Minnesotans’ livelihoods, especially when it comes to taxes, regulations and trade," Hagedorn said in a released statement. "For that reason, today I will urge President Trump to fight for our farmers and agribusinesses in trade negotiations to enhance stability and economic prosperity.

Not everyone is thrilled with Mr. Trump's Minnesota visit. CAIR-Minnesota (Council on American-Islamic Relations) held a rally at 11:30 a.m. on Monday outside the Burnsville business.

CAIR-MN called the rally "peaceful" and a way to show "solidarity" with communities impacted by the Trump administration.

The organization referenced recent controversy surrounding Rep. Ilhan Omar as an instance of these impacts.

The day before President Trump's visit, Sen. Amy Klobuchar held a press conference in Minneapolis to push back on his tax bill. Klobuchar, a Democratic presidential candidate for 2020, talked about her $1 trillion infrastructure plan.

"That tax bill was a major missed opportunity. That tax bill should have been a bill that would've not only brought some taxes down for working people, but also could've funded a major infrastructure investment. Here are the facts, our nation's infrastructure is crumbling," said Sen. Klobuchar, with the Interstate 35W bridge as her backdrop.

Part of Klobuchar's plan includes raising the corporate tax from 21 percent to 25 percent. Prior to Trump's tax law taking effect last year, the rate was at 35 percent.

"It's a steady source of funding for this and all of our colleagues keep talking about how they want to see movement on infrastructure and this is the opportunity to do it," Klobuchar said.

The nonpartisan Tax Policy Center estimated that about 80 percent of households would receive a tax cut in 2018. The center added it would reduce taxes by an average of $1,600 in 2018 with the biggest benefit going to households making $308,000 to $733,000. A recent poll from NBC News and the Wall Street Journal reported that just 17 percent believe their taxes will go down as a result of the tax overhaul.

More from KARE 11: