ST PAUL, Minn. — Minnesota Senate Republicans Thursday responded to Gov. Walz's proposed rebate checks with a plan that would deliver a permanent income tax cut.

It's the latest volley in a debate at the Minnesota State Capitol over how to use the projected $7.7 billion surplus for the current two-year budget cycle and reduce the surplus forecast for the next biennium.

"When you have a surplus this large it means one thing, and that’s the state of Minnesota is collecting too much money from the taxpayers," Senate Majority Leader Jeremy Miller told reporters at a news conference.

"We are proposing permanent, ongoing tax relief so working Minnesotans have more money in their pocket every single paycheck, week after week, month after month, year after year."

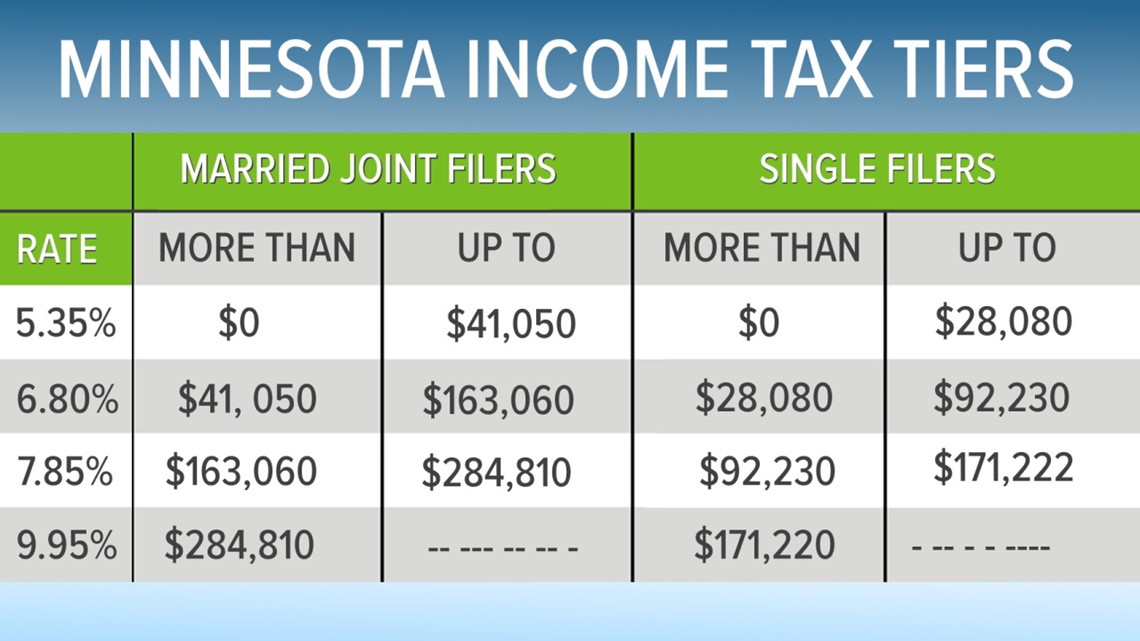

Sen. Miller and his cohorts are proposing cutting the state's first tier tax rate from 5.35% to 2.8% beginning with the current tax year. The first-tier rate applies to the first $41,000 of your income if you're filing a joint return, or the first $28,000 of your income if you're a single filer.

The senators said the average Minnesota family with a $75,000 income would see a tax cut of $908 per year, which would show up in paychecks as soon as the bill is passed and signed into law.

That compares to $375 rebate check for a family with that income floated by Gov. Walz as part of his supplemental budget plan.

"This bill delivers meaningful tax relief, not a gimmick, not a one-time check," Sen. Julia Coleman, a Chanhassen Republican, remarked.

The plan would use $3.5 billion of the budget surplus to pay for income tax cuts. They would also use another half billion dollars of the surplus to pay for making all Social Security benefits tax exempt, regardless of the taxpayer's total income.

In the government budgeting world, tax cuts are considered a form of spending, because they result in less tax revenue flowing to the state and reduce the projected surplus.

Lawmakers typically shrink the surplus with a combination of spending and tax reductions, while leaving part of it in a reserve account as a buffer against inflation and unexpected economic developments.

Rebate checks are considered one-time spending, while tax cuts are permanent changes to the state's tax code and will reverberate on the state's bottom line indefinitely. The GOP's proposed tax cuts would cost the state treasury $8.5 billion over the next three fiscal years.

Senate Democrats called the GOP tax cut plan premature, especially given the main news of the day, Russia's military invasion of Ukraine.

"We don’t know how the Russian invasion of Ukraine will impact Minnesota’s financial forecast. We don’t know how it will impact Minnesota’s economy," Sen. Kari Dziedzic, a Minneapolis Democrat, explained.

The DFL contingent also pointed out the GOP tax cuts would go to all taxpayers, regardless of income levels. They said there better ways to target tax cuts to meet specific goals for helping families.

"Through the Working Family Credit, through the Child Care Credit, through the Education Credit, through the Property Tax Refund program," Sen. Ann Rest, a New Hope Democrat told reporters.

"Those are much better and targeted opportunities for Minnesota to give tax reduction. We don’t have to spend the money on the millionaires in order to help working families."

The state's four income tax tiers kick in at different levels. For example, a family that earns $75,000 per year would be taxed at a rate of 5.35% on the first $41,050 of that and be taxed a 6.8% rate on the remainder of their income.

Exempting Social Security income from taxes is a longtime goal of Capitol Republicans. Minnesota is one of 13 states that still tax include Social Security as part of total taxable income.

Democrats have argued that most Social Security recipients don't have enough income to pay state income taxes, once all credits and deductions are taken into account.

Watch the latest political coverage from the Land of 10,000 Lakes in our YouTube playlist: