MINNEAPOLIS — Members of the Minnesota Multi-Housing Association are up in arms over two proposed Minneapolis ordinances that would limit who they can't rent to.

Under the two ordinances, drafted by Minneapolis Council President Lisa Bender and ward-5 council member Jeremiah Ellison, landlords would be barred from denying applicants with felony convictions over five years old, misdemeanors over two years old and arrests that never led to a conviction.

They also wouldn't be able to deny renters who have evictions over three years old...or credit scores under 500.

Property owners argue that's simply not fair.

"I find it hard to believe the city would walk into a bank in Minneapolis and tell them they could no longer use credit scores to underwrite for an auto loan or a mortgage loan," Minnesota Multi-Housing Association president Nichol Beckstrand says.

A second ordinance would also limit how much landlords can charge for a security deposit.

Ellison says the ordinance would limit security deposits to two months rent.

“That’s sort of the industry standard,” Ellison says.

Ellison says the two ordinances are all about removing barriers to low-income renters who he argues are victims of the city's low vacancy rate.

Council members are still hashing out the two ordinances and are asking property owners to help them out.

They hope to have a final version and a public hearing by the end of the summer.

Meanwhile, the Minnesota Multi-Housing Association is digging in, ready for a fight.

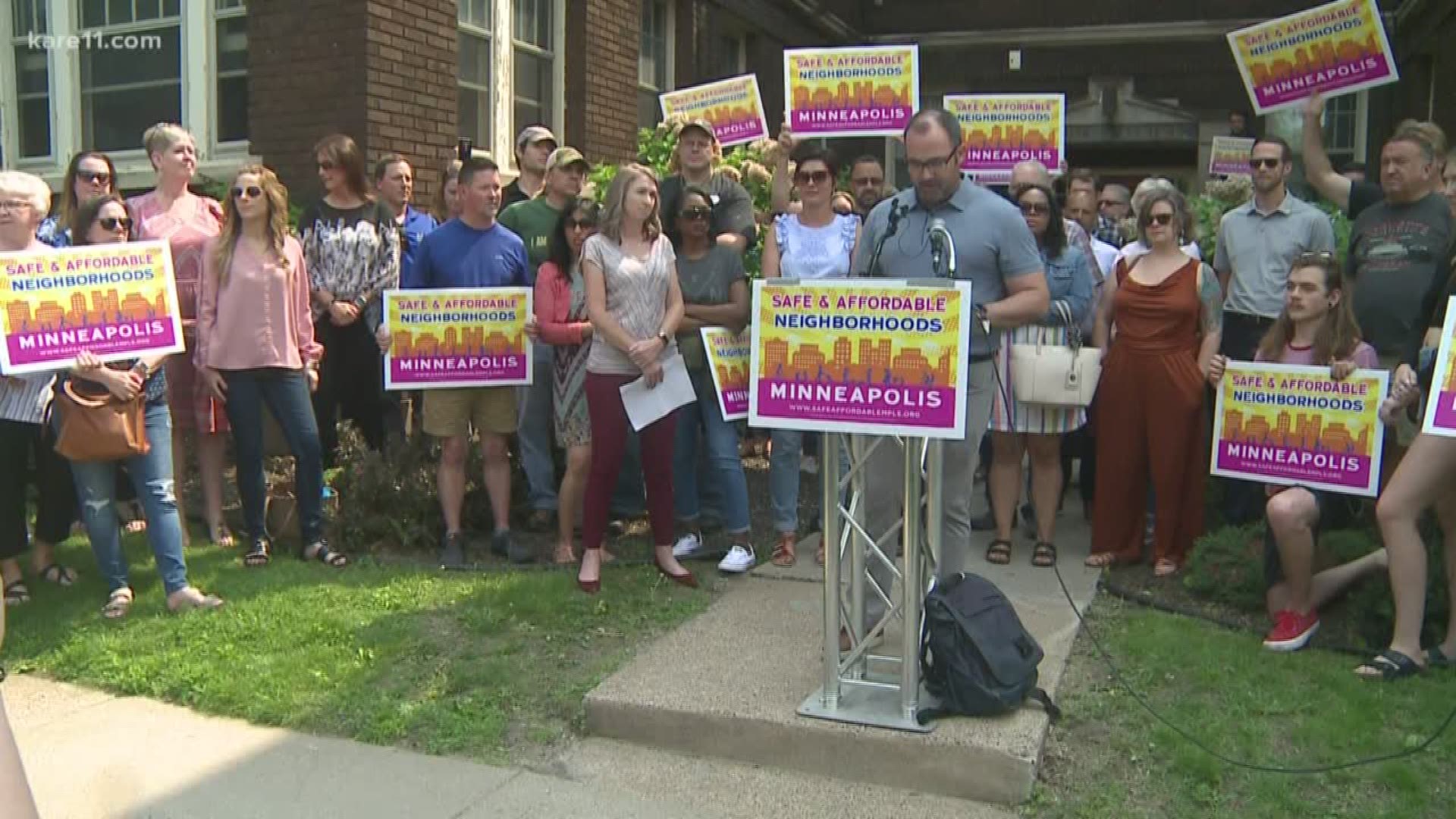

The group announced a new campaign, Safe and Affordable Neighborhoods Minneapolis, to educate the public on these two new ordinances.

“The negative impact is clear. They will mean higher costs for renters, more disruption and turnover in buildings, and less safety for everyone in the neighborhood,” Minnesota Multi-Housing Association Board Chairman Mike Garvin says.