If you own a home, you’ve probably at some time or another received a letter about a home warranty. A home warranty or extended warranty is a kind of service contract that covers the cost of certain repairs, much like one for your car, usually for a predetermined amount of money.

Sometimes, companies that sell home warranties market themselves by sending out letters in the mail. Several readers asked us if recent letters they had received about their home warranty that appeared to come from their mortgage company were scams.

THE QUESTION

Will your mortgage company send you mail about extending an expiring home warranty?

THE SOURCES

- Office of the Attorney General for the District of Columbia, Connecticut, Tennessee and Maryland

- Oregon Department of Justice

- Customer reviews and complaints submitted to the Better Business Bureau (BBB)

- TEG Federal Credit Union

- BankFirst

- Bankrate, an online personal finance information resource

- Home warranty companies American Home Protect and Cinch Home Services

THE ANSWER

No, your mortgage company will not send you mail about extending an expiring home warranty. If you receive such a letter, it’s a scam.

WHAT WE FOUND

If a letter claiming to be from or on behalf of your mortgage company says your home warranty is expiring or tries to pressure you into getting a home warranty, that’s a scam. The attorney general offices of several states have warned of this specific scam since last year.

Your mortgage company will not send you mail about a home warranty, and they don’t require homeowners to pay for warranties.

Here’s what we can VERIFY about home warranties and related scams.

What is a home warranty?

A home warranty is an optional agreement you make with a company to cover some repair and replacement of certain home systems and appliances, the Office of the Attorney General for the District of Columbia says. Think of your major kitchen appliances, or systems such as your plumbing, electrical and HVAC, says Bankrate, an online personal finance information resource. These policies typically add additional coverage on top of automatic manufacturer or builder warranties that may come standard with new homes or appliances.

This is not the same thing as home insurance. Home insurance covers property damage or liability in the event of an accident, and is typically required by mortgage lenders, the Office of the Connecticut Attorney General William Tong says. Home warranties are optional.

“While some home warranty companies may offer legitimate services, consumers should be cautious,” the Office of the Connecticut Attorney General says. “Home warranties may cost hundreds of dollars per year but not provide the coverage homeowners expect, may cover items that are already warrantied, and may impose high deductibles and service fees.”

Home warranty contracts can contain a number of conditions and exclusions limiting what they cover or pay, and may limit replacements to certain brands or repair to certain contractors. You may have to pay a portion of the repairs even if they’re covered.

Most states make legitimate home warranty companies register with a state insurance or consumer protection office, and some states even verify legitimate home warranty companies with licenses that are even harder to get than a registration. Compare Home Warranty Quotes, a website that allows consumers to compare prices of home warranty companies, has a public guide that breaks down the licensing and registration standards of each state.

What does a common home warranty scam look like?

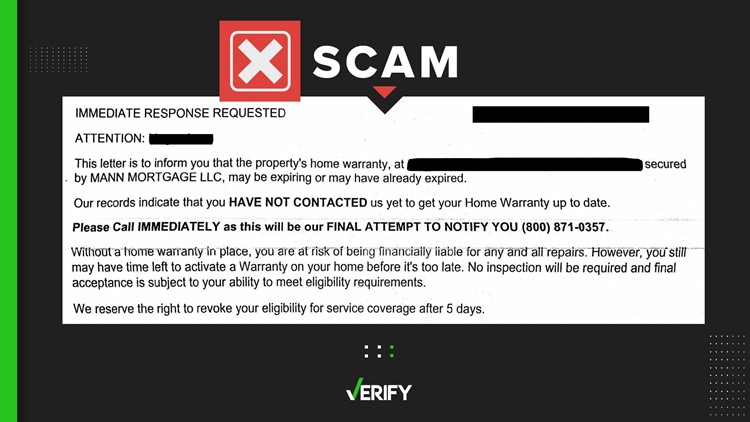

Although there are many, several states and banks have warned of one particular home warranty scam that has been common since last year. Victims of this scam report getting no service and finding the scammers won’t let them cancel their contract.

The scammers mail homeowners letters that imply they’re affiliated with the homeowner’s mortgage company and the “county deed records” office, according to Oregon's Department of Justice and the attorney general offices of Tennessee and Maryland.

The scammers know your mortgage company, address and may even have photos of your home because it’s all public information that can be obtained online, the state attorney general offices and banks say.

Regardless if the homeowner has ever even had a home warranty before, the letters claim that the homeowner’s home warranty has expired or is about to expire. It warns the homeowner they may be “financially liable” without a warranty, and that failing to respond could result in a potential loss of coverage.

Oregon, Tennessee and Connecticut all posted examples of these scam letters online. The letters sent by the scammers are almost identical in each of these states. They all come from the “Home Warranty Dept” of companies with similar sounding names — Home Warranty Solutions, Home Warranty Direct and Home Warranty Division. They also contain a fake $200 check.

If a consumer actually calls the phone number on the letter and agrees to the company’s home warranty contract, they later discover the company refuses to cover anything and makes it challenging or impossible to cancel, according to Better Business Bureau (BBB) reviews and complaints. Some customers reported they had to close their debit or credit card to stop the company from drawing further payments.

While the states issued their warnings in 2022, financial institutions have continued to make warnings and publish examples of this scam as recently as April 2023. These recent examples show the letters’ contents are the same as the letters from last year, and they only differ in the letter’s layout and the name of the company sending the letter.

How can I avoid falling victim to a home warranty scam?

The best way to avoid becoming a victim of a scam is to know how to identify it.

You should immediately be suspicious if the company’s marketing is aggressive. While some reputable home warranty companies may mail you marketing letters immediately after you purchase a new home, no one company should send you repeated letters or continue to send them months after you’ve settled into your new home.

Solicitations that use threatening language or unnecessary urgency are almost always scams, the attorney general offices of Tennessee and Maryland say. Home warranty companies have no way of knowing if you already have a home warranty, says American Home Protect, a home warranty company. So if a company you’ve never heard of says your home warranty is expiring, don't trust it.

There are several other red flags you can look for beyond the language of the initial letter, says Cinch Home Services, a home warranty company:

Unclear contracts: Vague policy terms can be difficult to enforce, so you don’t want to sign a contract unless it’s clear about what it does and doesn’t cover, including any appliance or system exclusions, coverage limits, pre-existing conditions, claim timelines and service wait times.

No state registration: A reputable company shouldn’t contact you unless it has approval to do business in your state.

Negative reviews and customer complaints: While even reputable companies may have negative reviews online, you should look out for repeated complaints of specific problematic behavior. Search for reviews on the BBB, Consumer Reports and Angi, and you can also reach out to your state’s insurance department or attorney general’s office to see if they’ve received complaints.

Difficult cancellation and claims process: If it’s difficult to reach a customer service representative, you should be suspicious. If you’ve already signed a contract and find that the claims or cancellation process is difficult and unclear, then you might be dealing with scammers.

Unexpected expenses: Any service fees and extra charges should be clearly listed in your contract. A reputable company shouldn’t hit you with unexpected charges that aren’t listed in the contract.

It’s important to review any contract before signing it for any of these red flags. Reviewing the contract can also help you figure out if the warranty is actually useful to you. Many of your appliances come with manufacturers’ factory warranties for a certain period of time.

If you want a home warranty plan from a legitimate company, you should start with your own research, the states’ attorney general offices say.

“Start by looking for warranty companies that service your neighborhood, ask friends and family for referrals, research what kind of coverage you need, compare coverage among companies, and pay attention to exclusions and limitations,” Oregon’s Department of Justice recommends. Tennessee, Maryland and Connecticut also recommend looking up home warranty companies on the Better Business Bureau (BBB).

And just like with anything else, never give out your personal details or payment information to someone reaching out unsolicited without confirming their identity. A scammer can use that information to take your money and/or steal your identity.

What do I do if I’m the victim of a home warranty scam?

Whether you’re a victim or just a target, you should report all home warranty scams to the FTC and your state’s attorney general office.

Contacting your bank may also help, especially if the scammer doesn’t let you cancel your plan. Your bank should be able to help you come up with a plan for stopping the scammers from taking any more of your money.